8 Min Read

8 Min Read

Understanding Types of Risk in Portfolio Management: A Complete Guide for Smart Investors

Understanding Types of Risk in Portfolio Management: A Complete Guide for Smart Investors

Understanding Types of Risk in Portfolio Management: A Complete Guide for Smart Investors

Learn about systematic, unsystematic, market, credit & liquidity risks in portfolio management. Discover risk elements & management strategies for HNIs.

Learn about systematic, unsystematic, market, credit & liquidity risks in portfolio management. Discover risk elements & management strategies for HNIs.

Learn about systematic, unsystematic, market, credit & liquidity risks in portfolio management. Discover risk elements & management strategies for HNIs.

Ckredence Wealth

Ckredence Wealth

|

January 2, 2026

January 2, 2026

Indian equity markets witnessed over 9.2 crore active investor accounts as of March 2024, yet portfolio losses from unmanaged risks continue to erode wealth across investor segments (NSE India, March 2024). Market downturns don't just happen. They're triggered by specific risk types that skilled investors can identify and prepare for. Understanding these risk categories separates investors who protect capital from those who watch portfolios decline during volatility.

How can systematic risks wipe out gains across your entire portfolio regardless of stock selection?

Why do certain investments become impossible to sell when you need cash urgently?

What causes bond values to drop even when companies remain financially healthy?

Portfolio management demands more than stock-picking ability. It requires identifying which of the 14 risk types threatens your investments and knowing exactly how each one impacts returns. Whether you're managing ₹50 lakhs or ₹10 crores, risk recognition drives better investment decisions than return chasing alone.

Key Takeaways

Systematic risks affect entire markets through economic shifts while unsystematic risks target specific companies or sectors

Market risk remains unavoidable through diversification alone and requires strategic asset allocation across multiple classes

Liquidity risk prevents quick asset conversion to cash without price discounts during urgent fund requirements

Credit risk in debt securities comes from issuer default probability affecting fixed-income portfolio components

Interest rate changes create inverse relationships with bond prices impacting fixed-income investment values

Concentration risk builds when portfolio allocation focuses heavily on single sectors or asset types

Climate and regulatory risks create sector-specific impacts requiring ongoing policy monitoring and adaptation

What Does Risk Mean in Portfolio Management?

Risk represents the probability of actual returns deviating from expected returns. It measures uncertainty in investment outcomes. When we talk about types of risk in portfolio management, we're identifying specific sources of this uncertainty.

Every investment carries some level of risk. The goal isn't elimination but identification and management. High-net-worth individuals need to understand that risk comes in multiple forms beyond just market volatility.

Portfolio risk shows up in two broad categories. Systematic risks affect the entire market. Unsystematic risks target specific companies or sectors. Knowing the difference helps in building better protection strategies.

Systematic vs. Unsystematic Risk Framework

Systematic Risk (Market Risk)

This risk type affects all investments across the market. Economic recessions impact every sector. Interest rate changes influence bond and equity markets simultaneously. Inflation reduces purchasing power for all asset classes.

Diversification cannot remove systematic risk. Even a well-spread portfolio faces losses during broad market declines. This is why understanding asset allocation in portfolio management services matters more than stock selection alone.

Unsystematic Risk (Specific Risk)

Company-specific factors create unsystematic risk. Poor management decisions hurt individual stocks. Sector regulations affect industry groups. Product failures damage company valuations without touching other sectors.

Proper diversification reduces unsystematic risk significantly. Spreading investments across 15-20 different sectors minimizes company-specific damage. This protection works because different stocks rarely face identical problems simultaneously.

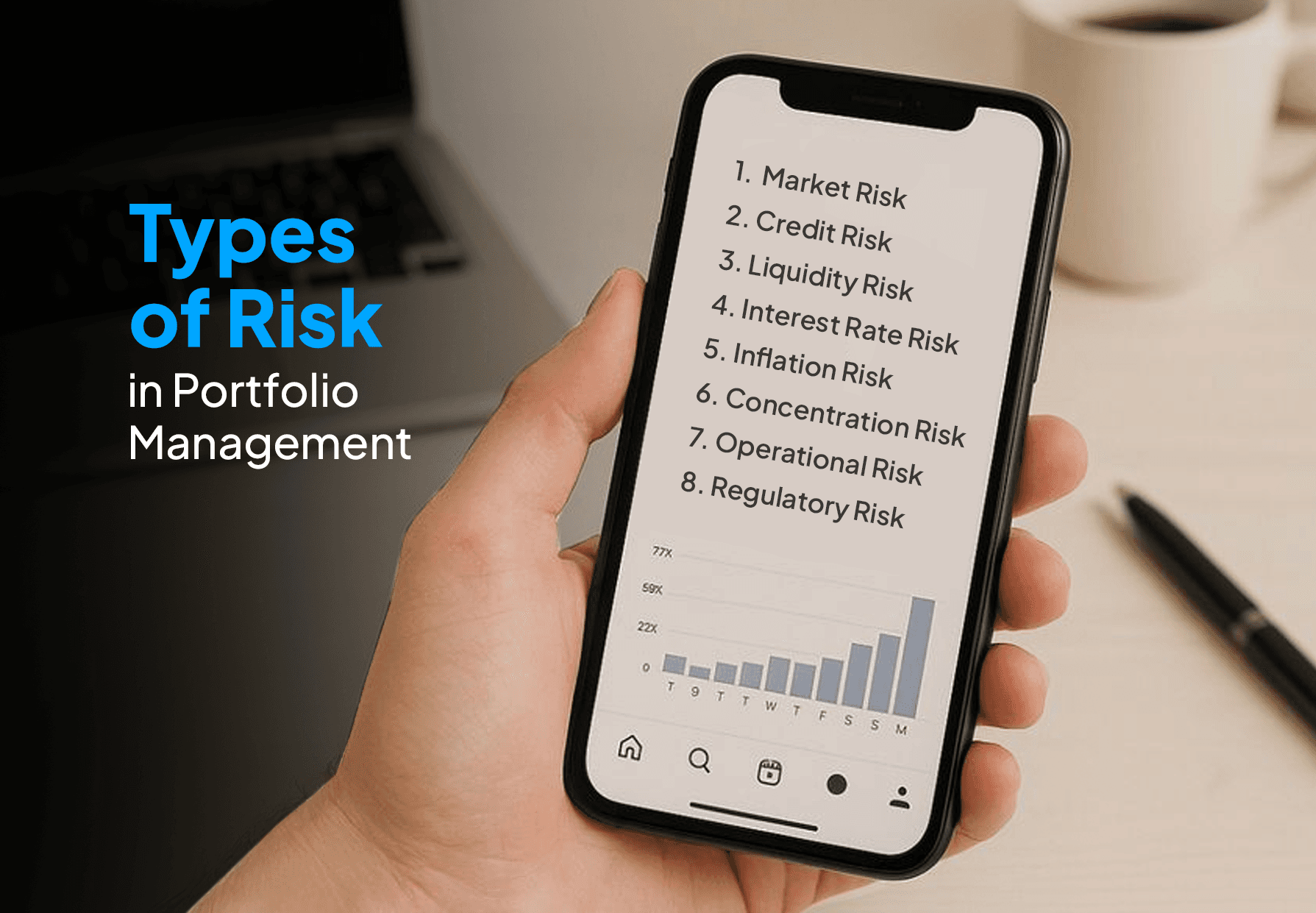

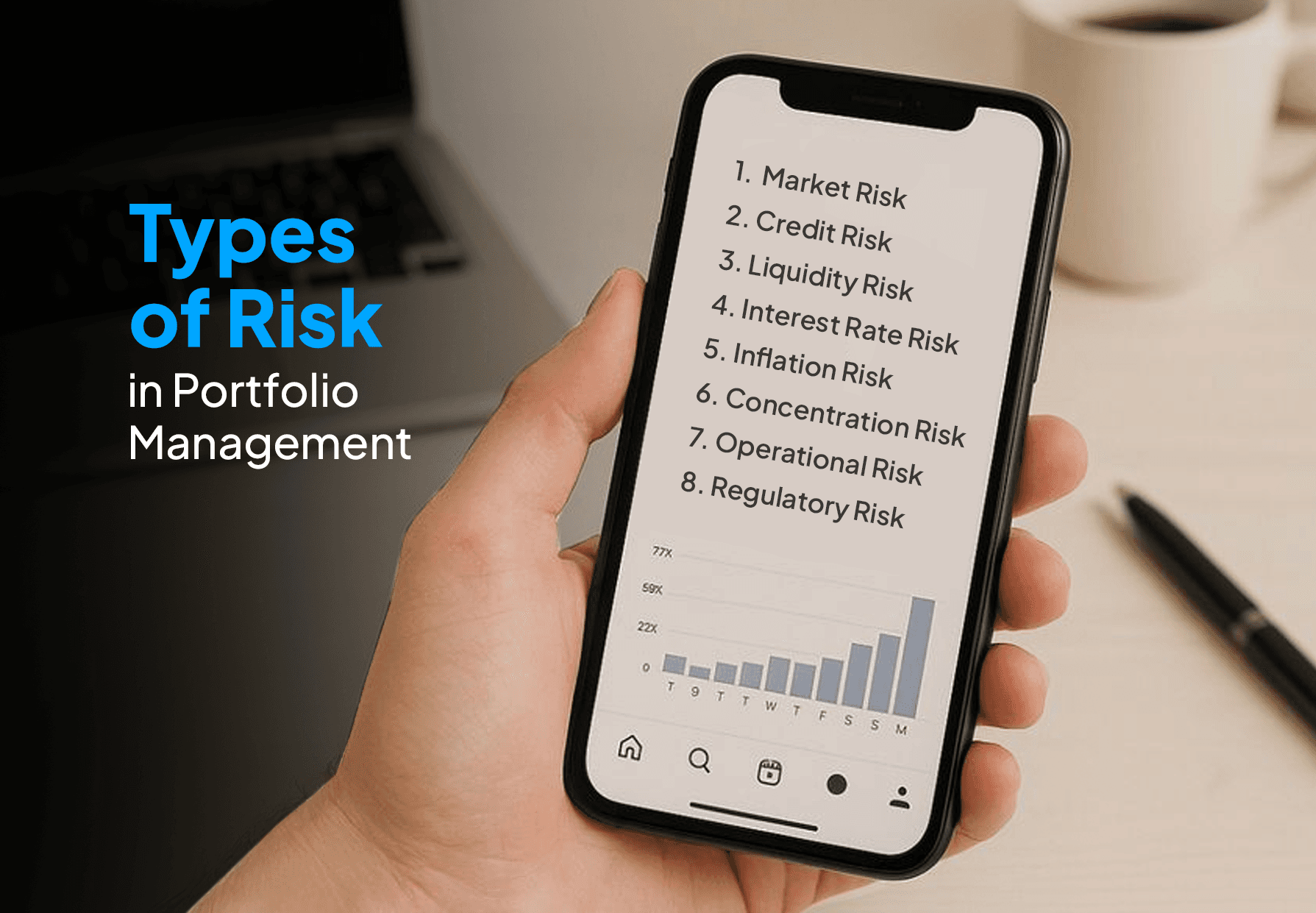

Types of Risk in Portfolio Management

1. Market Risk

Market risk stems from broad economic factors affecting all securities. Stock prices fall during recessions. Currency volatility impacts international holdings. Political instability creates widespread uncertainty.

Your equity-heavy portfolio loses value during market crashes regardless of individual stock quality. The 2020 COVID crash showed how systemic events override company fundamentals. Even well-managed businesses saw 30-40% declines.

Equity investors face the highest market risk exposure. Debt instruments carry lower but still significant market sensitivity. Real assets like gold provide partial hedges but don't eliminate this risk completely.

2. Credit Risk

Bond issuers may fail to meet payment obligations. This creates credit risk for debt security holders. Corporate bonds carry higher credit risk than government securities. Lower-rated bonds compensate investors through higher yields.

Default Impact on Portfolio Value

When bond issuers default, investors lose principal and interest payments. Portfolio values drop immediately. Recovery rates rarely exceed 40-50% of invested capital for defaulted bonds.

Credit rating agencies assess this risk through letter grades. AAA-rated bonds show minimal default probability. BB or lower ratings indicate substantial credit risk requiring higher return compensation.

3. Liquidity Risk

Some assets cannot convert to cash quickly without significant discounts. Real estate takes months to sell. Low-volume stocks lack ready buyers. Private equity locks capital for extended periods.

During emergencies, illiquid holdings force unfavorable sales. You might sell at 20-30% below fair value just to access funds. Market downturns worsen liquidity as buyers disappear completely.

Asset Liquidity Hierarchy

Cash and money market funds: Immediate liquidity

Large-cap stocks: 1-2 day settlement

Small-cap stocks: 3-5 days with potential discounts

Real estate: 3-6 months minimum

Private equity: Lock-in periods of 3-7 years

4. Interest Rate Risk

Bond prices move inversely to interest rates. When rates rise 1%, existing bond values typically fall 5-7% for 10-year maturities. This creates mark-to-market losses even without defaults.

Fixed-income investors face direct interest rate exposure. Bond portfolios lose value during rate hike cycles. The 2022-2023 period showed how aggressive rate increases damaged bond returns globally.

Longer duration bonds carry higher interest rate sensitivity. A 1% rate change impacts 20-year bonds twice as much as 10-year bonds. Portfolio managers adjust duration based on rate expectations, which is why bond portfolio management strategies require constant monitoring and tactical adjustments.

5. Inflation Risk

Rising prices erode investment purchasing power over time. A 6% inflation rate cuts portfolio value in half over 12 years without accounting for nominal gains. Fixed-income investments suffer most from inflation damage.

Equity investments provide some inflation protection through revenue growth. Companies often pass increased costs to customers. Real assets like gold and real estate historically track inflation better than bonds.

6. Concentration Risk

Heavy allocation to single sectors creates concentration risk. Technology-focused portfolios suffered 60-70% declines during the 2000 dot-com crash. Over-concentration in any sector magnifies downside during industry-specific problems.

Geographic Concentration

India-only portfolios miss global diversification benefits. Domestic economic slowdowns hit harder without international exposure. Balanced portfolios include 15-20% foreign assets to reduce country-specific concentration.

7. Operational Risk

Fund management errors damage portfolio performance. Trade execution mistakes cost investors directly. Cybersecurity breaches expose account information. Regulatory non-compliance creates legal penalties.

Back-office failures rarely make headlines but impact returns quietly. Delayed rebalancing misses opportunities. Poor record-keeping complicates tax planning. Professional portfolio managers minimize operational risk through robust systems.

8. Regulatory Risk

Government policy changes affect sector valuations overnight. The 2025 online gaming ban crashed related company stocks by 40-50%. Tax regulation modifications alter after-tax returns significantly.

Pharmaceutical companies face drug pricing controls. Real estate deals with changing property regulations. Energy sectors navigate environmental policy shifts. Staying informed about regulatory trends protects against sudden policy shocks.

How Risk Analysis Drives Better Portfolio Management

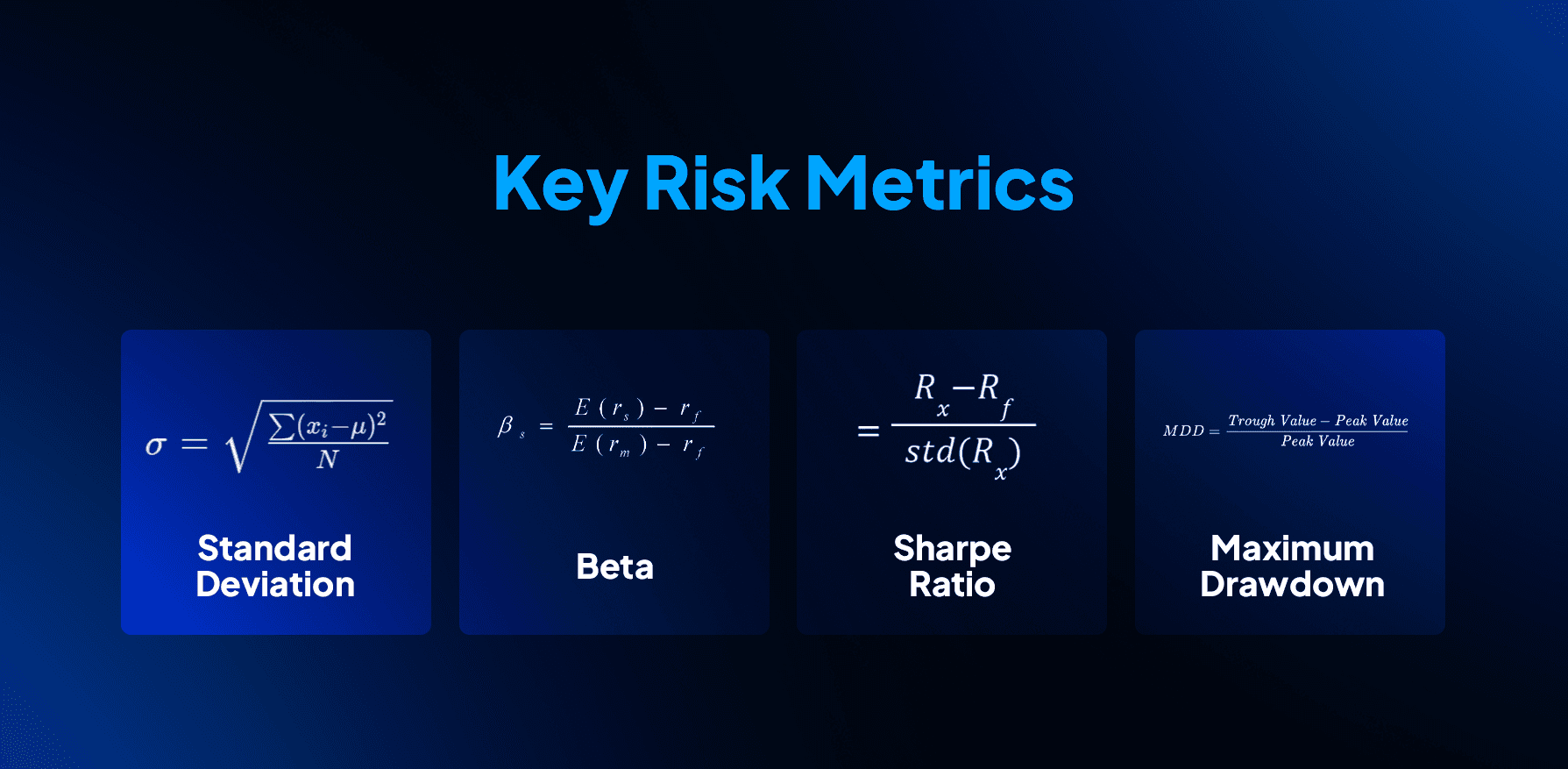

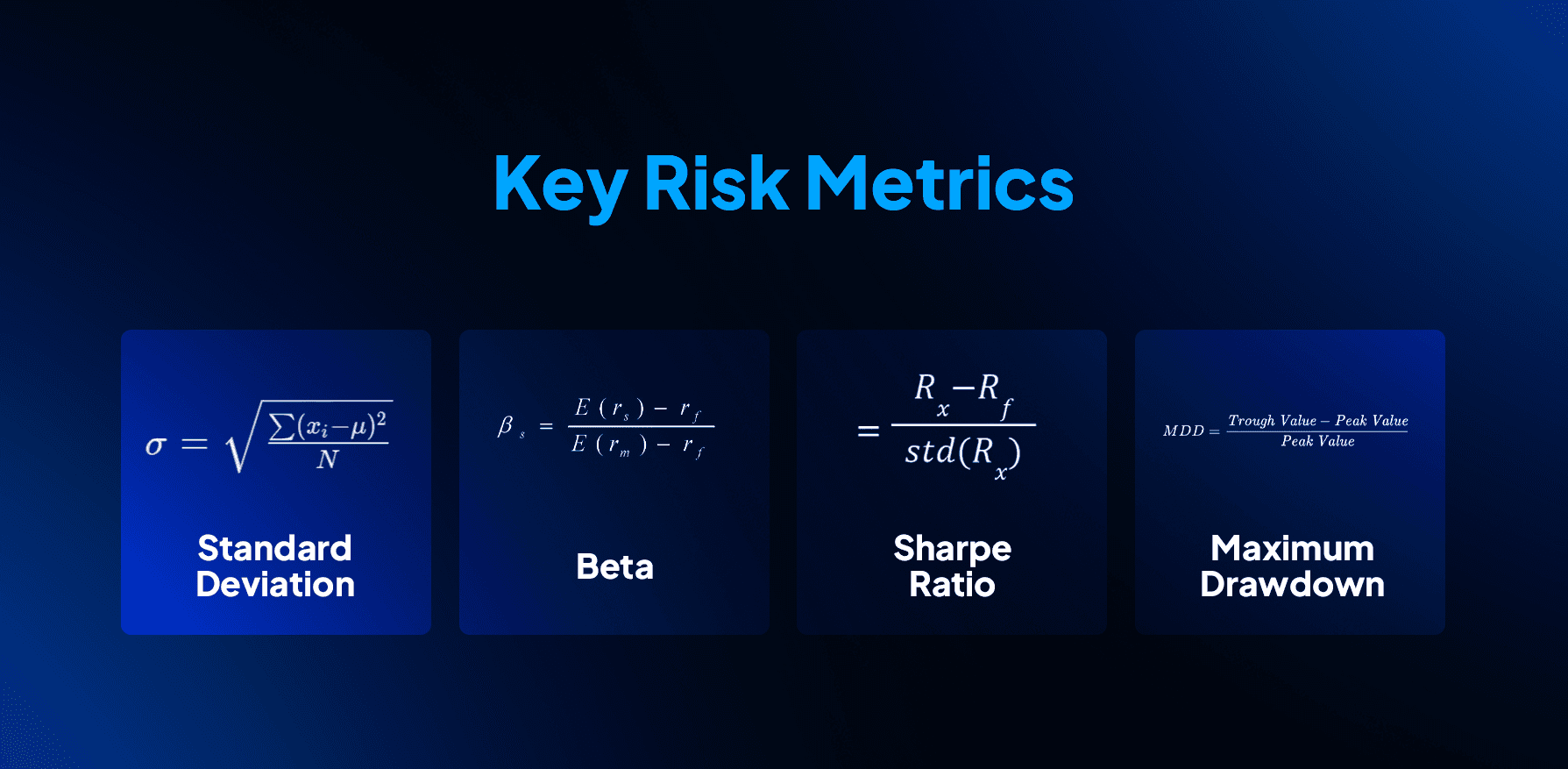

Risk measurement uses quantitative tools to assess portfolio vulnerability. Standard deviation measures return volatility. Beta compares stock movements against market indices. Value at Risk (VaR) estimates maximum potential losses.

Key Risk Metrics

Standard Deviation: Measures return variability around average performance

Beta: Shows systematic risk relative to market benchmark

Sharpe Ratio: Calculates risk-adjusted returns above risk-free rate

Maximum Drawdown: Tracks peak-to-trough portfolio decline

Regular risk analysis identifies emerging vulnerabilities before they cause damage. Monthly reviews catch concentration building up. Quarterly stress tests prepare portfolios for adverse scenarios. Annual assessments realign risk exposure with changing investor circumstances.

Diversification of Risk in Portfolio Management

Proper diversification spreads capital across multiple dimensions. Asset class diversification mixes equity, debt, real estate, and gold. Sector diversification prevents industry-specific concentration. Geographic diversification reduces country risk.

The right mix depends on investor risk tolerance and goals. Conservative investors favor 60% debt, 30% equity, 10% alternatives. Aggressive investors might hold 70% equity, 20% debt, 10% alternatives. Rebalancing maintains target allocations as markets move.

Multi-Layer Diversification Approach

Asset Level: Mix large-cap, mid-cap, small-cap stocks

Sector Level: Spread across 8-10 different industries

Geographic Level: Include domestic and international exposure

Time Level: Stagger investment entry through systematic plans

Dollar-cost averaging reduces timing risk. Fixed monthly investments buy more units when prices fall and fewer when prices rise. This mechanical approach removes emotional decision-making from investment execution.

Why Should You Choose Ckredence Wealth?

High-net-worth investors need professional guidance managing portfolio risks. Your investment approach must address all 14 risk types simultaneously. Ckredence Wealth provides this complete risk management framework through our Portfolio Management Services.

Solutions That Matter:

Risk-adjusted portfolio construction across market cycles

Multi-dimensional diversification reducing concentration exposure

SEBI-registered professional management with 37 years of legacy

Transparent fee structures aligned with performance outcomes

Proven Capabilities:

Client Assets: ₹805+ Crores managed with consistent capital preservation focus

Investment Approaches: 4 distinct strategies covering All Weather, Diversified, Business Cycle, and ICE Growth methodologies

Active Management: 376+ clients trusting our risk-adjusted approach

We help high-net-worth individuals build portfolios that withstand market volatility. Our strategies identify emerging risks before they damage returns. Dedicated relationship managers provide ongoing risk monitoring and adjustment recommendations.

Key Risk Management Features:

Systematic risk assessment using quantitative models

Regular portfolio stress testing against adverse scenarios

Dynamic rebalancing maintaining target risk exposure

Professional oversight minimizing operational failures

Smart investors recognize that risk management drives long-term wealth creation. Ckredence Wealth combines analytical rigor with personalized service to protect and grow your capital.

Ready to build a properly risk-managed portfolio? Schedule a Consultation!

Conclusion

Portfolio risk management starts with identifying all 14 types of risk affecting investments. Systematic risks like market and interest rate changes impact entire portfolios. Unsystematic risks from concentration, credit, or operational issues target specific holdings.

Successful risk management requires ongoing measurement and adjustment. Diversification across asset classes, sectors, and geographies reduces unsystematic exposure. Strategic allocation and stress testing prepare portfolios for adverse scenarios. Professional guidance helps high-net-worth investors implement these strategies consistently.

FAQs

How does market risk differ from credit risk in portfolios?

Market risk affects all securities through economic factors. Credit risk involves specific bond issuer default probability. Market risk cannot be eliminated through diversification alone.

What is the main element of risk in portfolio management?

Systematic risk represents the primary element. It impacts entire markets through inflation, interest rates, and economic cycles. Proper asset allocation manages this unavoidable risk type.

Can diversification eliminate all types of portfolio risk?

Diversification reduces unsystematic risk from concentration and company-specific factors. It cannot eliminate systematic risks affecting entire markets. Both strategies together provide better protection.

Why does liquidity risk matter for high-net-worth investors?

Liquidity risk prevents quick asset sales without price discounts. Emergency fund needs may force selling illiquid holdings at 20-30% below value. Maintaining adequate liquid reserves prevents this problem.

Indian equity markets witnessed over 9.2 crore active investor accounts as of March 2024, yet portfolio losses from unmanaged risks continue to erode wealth across investor segments (NSE India, March 2024). Market downturns don't just happen. They're triggered by specific risk types that skilled investors can identify and prepare for. Understanding these risk categories separates investors who protect capital from those who watch portfolios decline during volatility.

How can systematic risks wipe out gains across your entire portfolio regardless of stock selection?

Why do certain investments become impossible to sell when you need cash urgently?

What causes bond values to drop even when companies remain financially healthy?

Portfolio management demands more than stock-picking ability. It requires identifying which of the 14 risk types threatens your investments and knowing exactly how each one impacts returns. Whether you're managing ₹50 lakhs or ₹10 crores, risk recognition drives better investment decisions than return chasing alone.

Key Takeaways

Systematic risks affect entire markets through economic shifts while unsystematic risks target specific companies or sectors

Market risk remains unavoidable through diversification alone and requires strategic asset allocation across multiple classes

Liquidity risk prevents quick asset conversion to cash without price discounts during urgent fund requirements

Credit risk in debt securities comes from issuer default probability affecting fixed-income portfolio components

Interest rate changes create inverse relationships with bond prices impacting fixed-income investment values

Concentration risk builds when portfolio allocation focuses heavily on single sectors or asset types

Climate and regulatory risks create sector-specific impacts requiring ongoing policy monitoring and adaptation

What Does Risk Mean in Portfolio Management?

Risk represents the probability of actual returns deviating from expected returns. It measures uncertainty in investment outcomes. When we talk about types of risk in portfolio management, we're identifying specific sources of this uncertainty.

Every investment carries some level of risk. The goal isn't elimination but identification and management. High-net-worth individuals need to understand that risk comes in multiple forms beyond just market volatility.

Portfolio risk shows up in two broad categories. Systematic risks affect the entire market. Unsystematic risks target specific companies or sectors. Knowing the difference helps in building better protection strategies.

Systematic vs. Unsystematic Risk Framework

Systematic Risk (Market Risk)

This risk type affects all investments across the market. Economic recessions impact every sector. Interest rate changes influence bond and equity markets simultaneously. Inflation reduces purchasing power for all asset classes.

Diversification cannot remove systematic risk. Even a well-spread portfolio faces losses during broad market declines. This is why understanding asset allocation in portfolio management services matters more than stock selection alone.

Unsystematic Risk (Specific Risk)

Company-specific factors create unsystematic risk. Poor management decisions hurt individual stocks. Sector regulations affect industry groups. Product failures damage company valuations without touching other sectors.

Proper diversification reduces unsystematic risk significantly. Spreading investments across 15-20 different sectors minimizes company-specific damage. This protection works because different stocks rarely face identical problems simultaneously.

Types of Risk in Portfolio Management

1. Market Risk

Market risk stems from broad economic factors affecting all securities. Stock prices fall during recessions. Currency volatility impacts international holdings. Political instability creates widespread uncertainty.

Your equity-heavy portfolio loses value during market crashes regardless of individual stock quality. The 2020 COVID crash showed how systemic events override company fundamentals. Even well-managed businesses saw 30-40% declines.

Equity investors face the highest market risk exposure. Debt instruments carry lower but still significant market sensitivity. Real assets like gold provide partial hedges but don't eliminate this risk completely.

2. Credit Risk

Bond issuers may fail to meet payment obligations. This creates credit risk for debt security holders. Corporate bonds carry higher credit risk than government securities. Lower-rated bonds compensate investors through higher yields.

Default Impact on Portfolio Value

When bond issuers default, investors lose principal and interest payments. Portfolio values drop immediately. Recovery rates rarely exceed 40-50% of invested capital for defaulted bonds.

Credit rating agencies assess this risk through letter grades. AAA-rated bonds show minimal default probability. BB or lower ratings indicate substantial credit risk requiring higher return compensation.

3. Liquidity Risk

Some assets cannot convert to cash quickly without significant discounts. Real estate takes months to sell. Low-volume stocks lack ready buyers. Private equity locks capital for extended periods.

During emergencies, illiquid holdings force unfavorable sales. You might sell at 20-30% below fair value just to access funds. Market downturns worsen liquidity as buyers disappear completely.

Asset Liquidity Hierarchy

Cash and money market funds: Immediate liquidity

Large-cap stocks: 1-2 day settlement

Small-cap stocks: 3-5 days with potential discounts

Real estate: 3-6 months minimum

Private equity: Lock-in periods of 3-7 years

4. Interest Rate Risk

Bond prices move inversely to interest rates. When rates rise 1%, existing bond values typically fall 5-7% for 10-year maturities. This creates mark-to-market losses even without defaults.

Fixed-income investors face direct interest rate exposure. Bond portfolios lose value during rate hike cycles. The 2022-2023 period showed how aggressive rate increases damaged bond returns globally.

Longer duration bonds carry higher interest rate sensitivity. A 1% rate change impacts 20-year bonds twice as much as 10-year bonds. Portfolio managers adjust duration based on rate expectations, which is why bond portfolio management strategies require constant monitoring and tactical adjustments.

5. Inflation Risk

Rising prices erode investment purchasing power over time. A 6% inflation rate cuts portfolio value in half over 12 years without accounting for nominal gains. Fixed-income investments suffer most from inflation damage.

Equity investments provide some inflation protection through revenue growth. Companies often pass increased costs to customers. Real assets like gold and real estate historically track inflation better than bonds.

6. Concentration Risk

Heavy allocation to single sectors creates concentration risk. Technology-focused portfolios suffered 60-70% declines during the 2000 dot-com crash. Over-concentration in any sector magnifies downside during industry-specific problems.

Geographic Concentration

India-only portfolios miss global diversification benefits. Domestic economic slowdowns hit harder without international exposure. Balanced portfolios include 15-20% foreign assets to reduce country-specific concentration.

7. Operational Risk

Fund management errors damage portfolio performance. Trade execution mistakes cost investors directly. Cybersecurity breaches expose account information. Regulatory non-compliance creates legal penalties.

Back-office failures rarely make headlines but impact returns quietly. Delayed rebalancing misses opportunities. Poor record-keeping complicates tax planning. Professional portfolio managers minimize operational risk through robust systems.

8. Regulatory Risk

Government policy changes affect sector valuations overnight. The 2025 online gaming ban crashed related company stocks by 40-50%. Tax regulation modifications alter after-tax returns significantly.

Pharmaceutical companies face drug pricing controls. Real estate deals with changing property regulations. Energy sectors navigate environmental policy shifts. Staying informed about regulatory trends protects against sudden policy shocks.

How Risk Analysis Drives Better Portfolio Management

Risk measurement uses quantitative tools to assess portfolio vulnerability. Standard deviation measures return volatility. Beta compares stock movements against market indices. Value at Risk (VaR) estimates maximum potential losses.

Key Risk Metrics

Standard Deviation: Measures return variability around average performance

Beta: Shows systematic risk relative to market benchmark

Sharpe Ratio: Calculates risk-adjusted returns above risk-free rate

Maximum Drawdown: Tracks peak-to-trough portfolio decline

Regular risk analysis identifies emerging vulnerabilities before they cause damage. Monthly reviews catch concentration building up. Quarterly stress tests prepare portfolios for adverse scenarios. Annual assessments realign risk exposure with changing investor circumstances.

Diversification of Risk in Portfolio Management

Proper diversification spreads capital across multiple dimensions. Asset class diversification mixes equity, debt, real estate, and gold. Sector diversification prevents industry-specific concentration. Geographic diversification reduces country risk.

The right mix depends on investor risk tolerance and goals. Conservative investors favor 60% debt, 30% equity, 10% alternatives. Aggressive investors might hold 70% equity, 20% debt, 10% alternatives. Rebalancing maintains target allocations as markets move.

Multi-Layer Diversification Approach

Asset Level: Mix large-cap, mid-cap, small-cap stocks

Sector Level: Spread across 8-10 different industries

Geographic Level: Include domestic and international exposure

Time Level: Stagger investment entry through systematic plans

Dollar-cost averaging reduces timing risk. Fixed monthly investments buy more units when prices fall and fewer when prices rise. This mechanical approach removes emotional decision-making from investment execution.

Why Should You Choose Ckredence Wealth?

High-net-worth investors need professional guidance managing portfolio risks. Your investment approach must address all 14 risk types simultaneously. Ckredence Wealth provides this complete risk management framework through our Portfolio Management Services.

Solutions That Matter:

Risk-adjusted portfolio construction across market cycles

Multi-dimensional diversification reducing concentration exposure

SEBI-registered professional management with 37 years of legacy

Transparent fee structures aligned with performance outcomes

Proven Capabilities:

Client Assets: ₹805+ Crores managed with consistent capital preservation focus

Investment Approaches: 4 distinct strategies covering All Weather, Diversified, Business Cycle, and ICE Growth methodologies

Active Management: 376+ clients trusting our risk-adjusted approach

We help high-net-worth individuals build portfolios that withstand market volatility. Our strategies identify emerging risks before they damage returns. Dedicated relationship managers provide ongoing risk monitoring and adjustment recommendations.

Key Risk Management Features:

Systematic risk assessment using quantitative models

Regular portfolio stress testing against adverse scenarios

Dynamic rebalancing maintaining target risk exposure

Professional oversight minimizing operational failures

Smart investors recognize that risk management drives long-term wealth creation. Ckredence Wealth combines analytical rigor with personalized service to protect and grow your capital.

Ready to build a properly risk-managed portfolio? Schedule a Consultation!

Conclusion

Portfolio risk management starts with identifying all 14 types of risk affecting investments. Systematic risks like market and interest rate changes impact entire portfolios. Unsystematic risks from concentration, credit, or operational issues target specific holdings.

Successful risk management requires ongoing measurement and adjustment. Diversification across asset classes, sectors, and geographies reduces unsystematic exposure. Strategic allocation and stress testing prepare portfolios for adverse scenarios. Professional guidance helps high-net-worth investors implement these strategies consistently.

FAQs

How does market risk differ from credit risk in portfolios?

Market risk affects all securities through economic factors. Credit risk involves specific bond issuer default probability. Market risk cannot be eliminated through diversification alone.

What is the main element of risk in portfolio management?

Systematic risk represents the primary element. It impacts entire markets through inflation, interest rates, and economic cycles. Proper asset allocation manages this unavoidable risk type.

Can diversification eliminate all types of portfolio risk?

Diversification reduces unsystematic risk from concentration and company-specific factors. It cannot eliminate systematic risks affecting entire markets. Both strategies together provide better protection.

Why does liquidity risk matter for high-net-worth investors?

Liquidity risk prevents quick asset sales without price discounts. Emergency fund needs may force selling illiquid holdings at 20-30% below value. Maintaining adequate liquid reserves prevents this problem.