7 Min Read

7 Min Read

Smart Investment in IPO: How to Evaluate, Apply, and Build Wealth from Every Issue

Smart Investment in IPO: How to Evaluate, Apply, and Build Wealth from Every Issue

Smart Investment in IPO: How to Evaluate, Apply, and Build Wealth from Every Issue

Learn how to make smart IPO investments from DRHP analysis and GMP signals to ASBA application and expert HNI portfolio strategies

Learn how to make smart IPO investments from DRHP analysis and GMP signals to ASBA application and expert HNI portfolio strategies

Learn how to make smart IPO investments from DRHP analysis and GMP signals to ASBA application and expert HNI portfolio strategies

Ckredence Wealth

Ckredence Wealth

|

February 19, 2026

February 19, 2026

India's IPO market has grown into one of the most active in the world. According to PRIME Database, Indian companies raised over ₹2,11,151 crore through IPOs, follow-on offers, and offers for sale in 2024. This was the highest ever recorded in a single calendar year.

Is every IPO that opens worth your money, or are most of them just noise?

What does the DRHP actually tell you before you put your capital on the line?

How do investors with similar profiles walk away with very different outcomes from the same IPO?

For investors who want more than just a lucky allotment, a smart investment IPO approach begins long before the bidding window opens. It starts with a clear-eyed reading of the fundamentals, an honest look at valuation, and a decision about how this issue fits into the broader portfolio.

This guide covers each of those steps from DRHP evaluation to post-listing planning. You can stop reacting to IPO hype and start making decisions backed by real analysis.

Key Takeaways

Check the DRHP "Objects of the Issue" section to see if funds go toward growth or investor exits

HNI/NII category gives proportionate allotment for investments above ₹10 lakhs instead of retail lottery

Grey Market Premium shows sentiment, not guarantees high GMP without strong fundamentals often leads to weak listing gains

QIB subscription levels reliably indicate institutional confidence in an IPO

ASBA keeps funds in your account until allotment, reducing opportunity cost

Applying through family members' separate Demat accounts legally improves allotment chances in sHNI category

Plan ahead: decide whether to book listing profits or hold long-term based on company fundamentals

What Makes an IPO a Smart Investment?

Not every IPO deserves your capital. The difference between a smart investment IPO and a reactive one lies in how much homework you do before the issue opens.

A company going public is essentially asking investors to fund its next chapter. The question you need to answer is whether that next chapter is worth funding. To do that well, you need to look at three things: where the money is going, what the business looks like financially, and whether the price is fair given industry comparables.

The three filters for every IPO:

1. Growth Intent vs. Exit Intent Check the "Objects of the Issue" in the DRHP. If most of the funds raised go toward expansion, R&D, or debt reduction for productive assets, that is a growth-oriented IPO. If a large chunk goes toward an Offer for Sale (OFS), existing shareholders, promoters or PE investors are cashing out. This doesn't make the IPO bad by default, but it changes what you are buying into.

2. Revenue and Profit Trend Look at three years of revenue, EBITDA, and PAT data. A company with shrinking margins or inconsistent profits going into an IPO at high valuations is a red flag. Strong businesses typically show consistent top-line growth with improving or stable margins.

3. Price-to-Earnings Relative to Listed Peers Compare the IPO's P/E ratio against companies already listed in the same sector. If the IPO is priced at a steep premium to the sector average without a clear reason higher growth rate, unique positioning, market leadership the valuation is a concern. Overpriced issues tend to list flat or below issue price.

These three filters alone will help you move past the noise and focus on issues worth your time and capital. The next step is going deeper into the DRHP.

How to Read the DRHP Before Every Smart IPO Investment

The Draft Red Herring Prospectus is the most information-dense document available for any IPO. Most investors skip it. The ones who read it are usually better prepared for what happens post-listing.

The DRHP is filed with SEBI before the IPO opens. It is publicly available on the SEBI website and the company's website. Reading it fully can take a few hours, but there are specific sections that give you the most useful signals quickly.

The "Risk Factors" Section

This section is written by the company's lawyers and describes every material risk they are legally required to disclose. Read it with intent. Recurring mentions of regulatory exposure, litigation, client concentration, or promoter-related issues are things to weigh seriously. A long risk section doesn't mean a bad company — but a pattern of the same risks appearing in multiple forms is a signal.

Financial Statements and Restated Accounts

Look at the restated financials, not just the current year. Sudden profitability just before the IPO filing especially after years of losses can indicate earnings management. Check if the company consistently converts revenue into cash by reviewing operating cash flow against reported profits.

Promoter Background and Shareholding

A promoter with a strong track record in the same sector, holding a significant stake post-IPO, signals confidence. Heavy dilution by promoters at IPO stage is worth questioning. Also review the lock-in period for promoter shares when they are free to sell matters for long-term price stability.

Understanding the DRHP is only one part of the picture. What the grey market says about an IPO before listing adds a different layer of insight one that carries its own limitations.

Understanding Grey Market Premium in Smart IPO Investing

The Grey Market Premium, or GMP, is the unofficial price at which IPO shares trade before they are listed on stock exchanges. It reflects what buyers in informal markets are willing to pay above the issue price based on early demand signals.

GMP is not regulated by SEBI and operates outside formal market infrastructure. It is sourced from dealer networks and informal channels. As a result, it is speculative by nature and should not be the primary basis for any IPO investment decision.

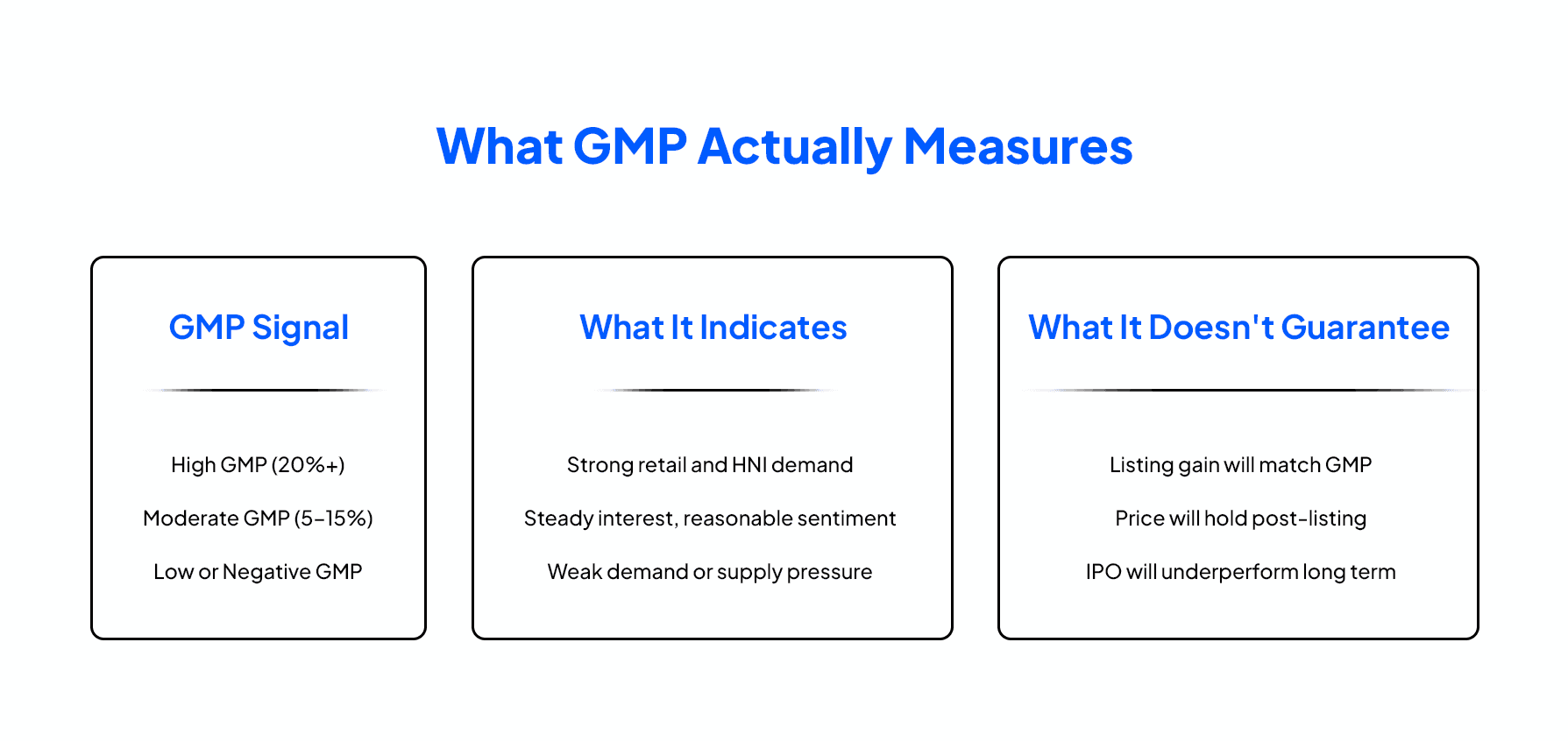

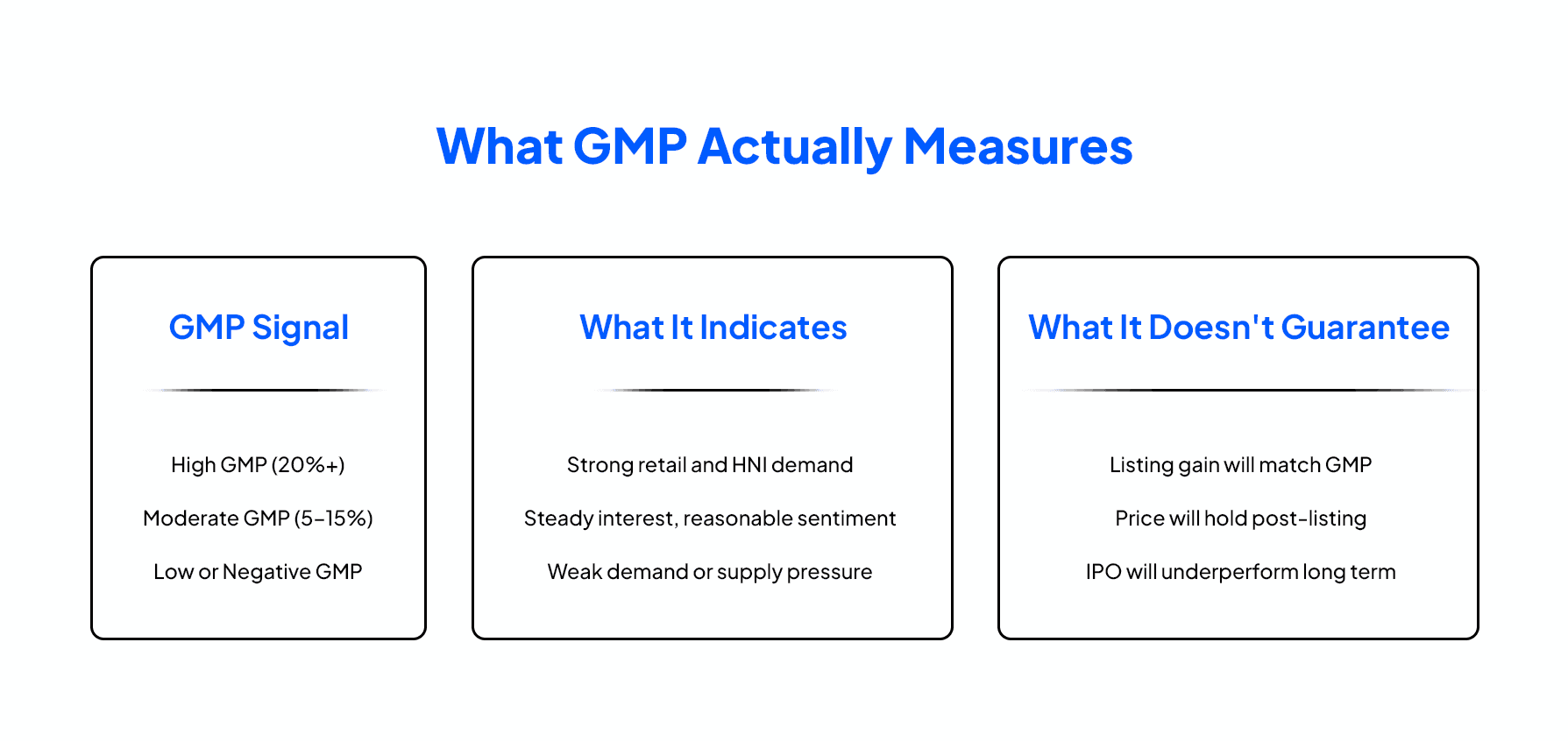

What GMP Actually Measures

A high GMP means strong demand exists in informal markets. It often correlates with high subscription numbers and positive listing days but not always. There have been well-known cases where IPOs with very high GMP listed below issue price because the fundamental case didn't support the sentiment.

When GMP Is Useful And When It Isn't

GMP is a useful cross-reference tool, not a decision driver. When a high GMP is backed by strong subscription data, solid fundamentals, and reasonable valuation, it adds confidence to an already well-researched position.

When GMP is high but the DRHP shows weak fundamentals or stretched valuations, the grey market is usually pricing in short-term listing momentum — not business value. Treat it as one data point, not the final word.

IPO Categories in India: Where HNI Investors Fit

Every mainboard IPO in India is divided into three investor categories: Retail Individual Investors (RII), Non-Institutional Investors (NII/HNI), and Qualified Institutional Buyers (QIB). Each category has its own allocation, rules, and allotment process.

Under current SEBI guidelines, the sHNI category does not use a proportionate allotment system during oversubscription; it has shifted to a lottery-based system similar to the retail category.

sHNI - Small HNI (₹2 Lakh to ₹10 Lakh)

Allocation: One-third (1/3rd) of the total NII quota.

Allotment Method: If oversubscribed, allotment is done via a computerised lottery system, not proportionately. Winners in this lottery receive the full minimum application size (shares worth roughly ₹2 lakh).

Odds: While it is a lottery, it often has lower oversubscription levels than the Retail category, which can offer mathematically better odds for some investors.

bHNI - Big HNI (Above ₹10 Lakh)

Allocation: Two-thirds (2/3rd) of the total NII quota.

Allotment Method: Typically follows proportionate allotment for oversubscribed issues. However, recent rules ensure that every successful applicant first receives at least one minimum lot before the remaining shares are distributed pro-rata.

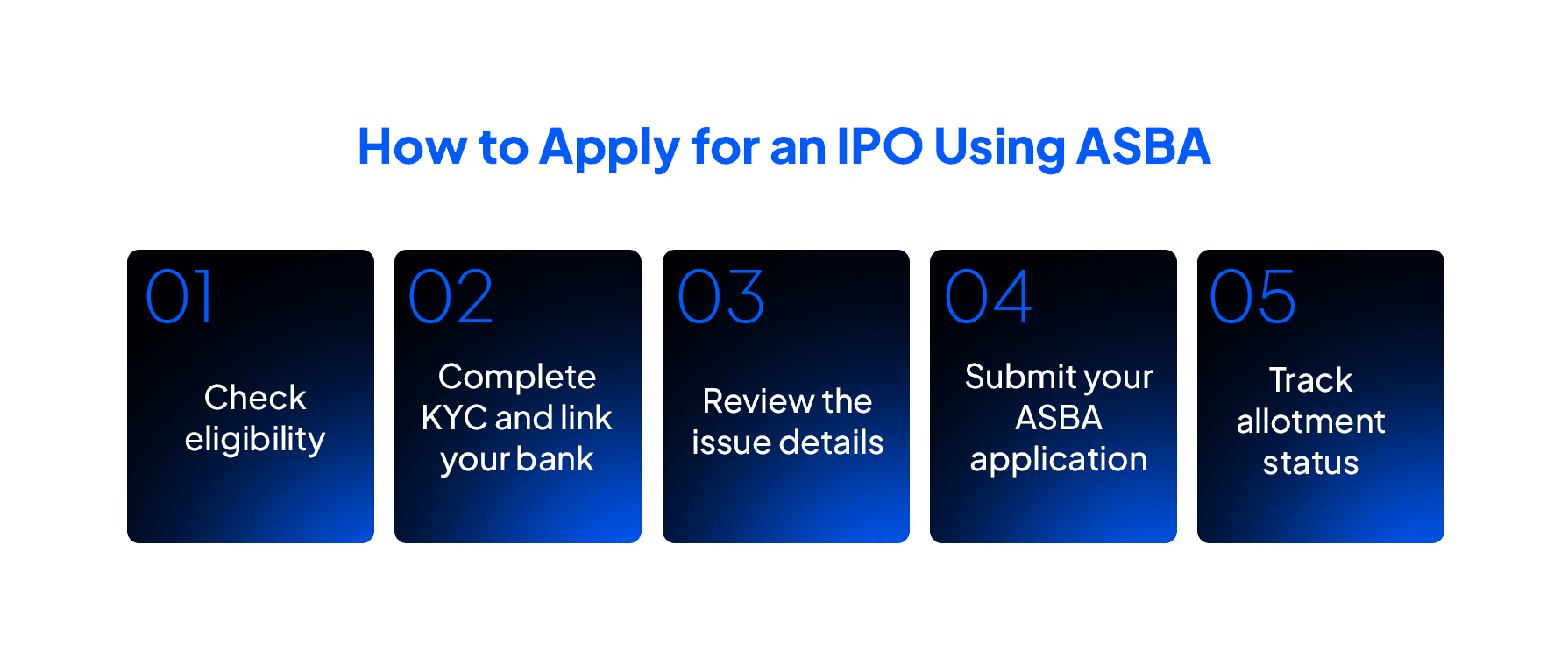

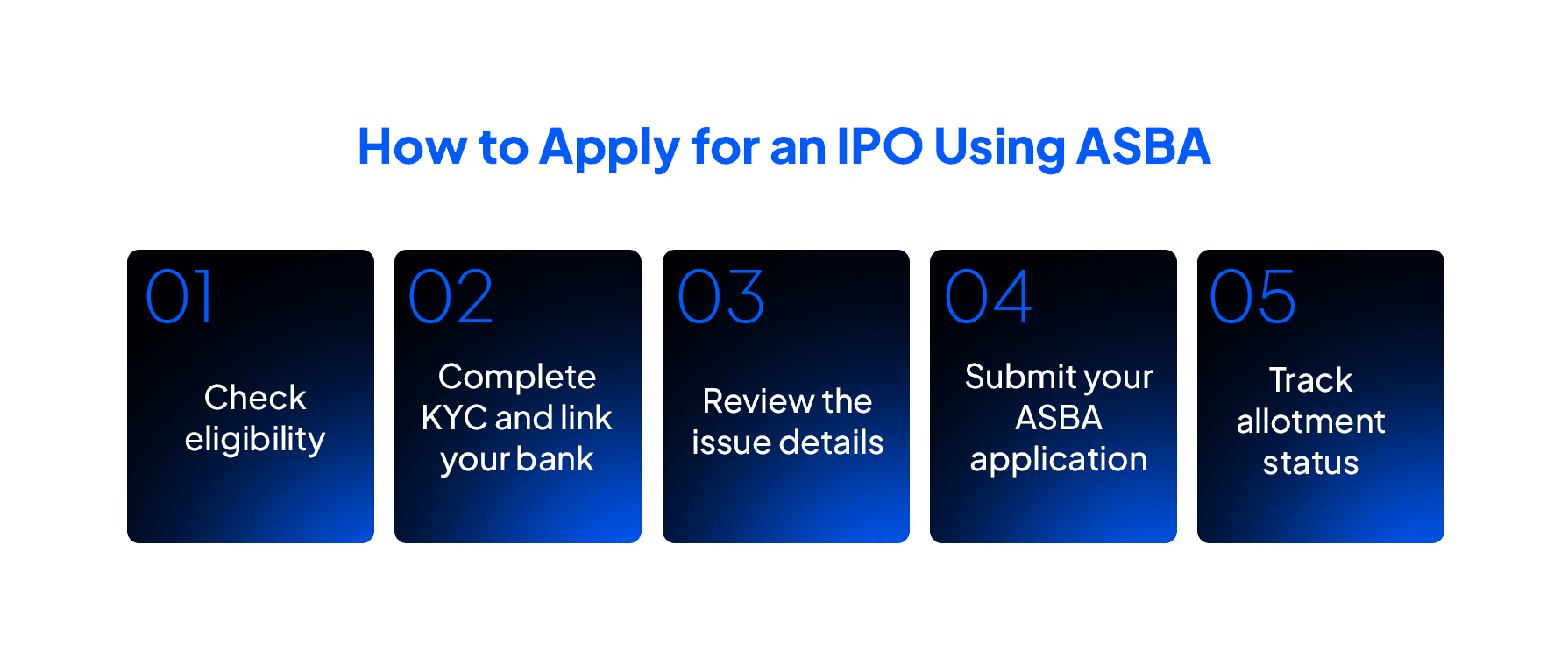

How to Apply for an IPO Using ASBA Step-by-Step

For HNI investors, Application Supported by Blocked Amount (ASBA) is the standard SEBI-approved method for IPO applications. The amount is blocked in your bank account and only debited on allotment day. Non-allotted funds are released automatically.

The steps involved are:

Check eligibility - Confirm you have an active Demat and trading account with a broker that supports IPO applications and HNI bids above ₹2 lakh.

Complete KYC and link your bank - Your PAN, Demat account, and ASBA-linked bank account must all be in order before applying.

Review the issue details - Check the IPO opening and closing dates, price band, lot size, and NII allocation from the prospectus or your broker platform.

Submit your ASBA application - Log into your net banking or broker portal, go to IPO Application, select the NII/HNI category, enter the number of lots, and bid at the upper end of the price band. HNIs cannot bid at cut-off price.

Track allotment status - After the issue closes, check allotment on the registrar's website or NSE India. Blocked funds are released within a few business days for non-allotted applications.

A practical note: Most banks stop accepting HNI ASBA applications by 2:00 PM to 3:00 PM on the last day of bidding. Retail investors often get until 4:00 PM. Do not wait until the last hour if you are applying in the HNI category.

Common Mistakes That Turn Smart IPO Investments Into Losses

Even investors who research well sometimes make avoidable errors in execution. These mistakes don't require complex analysis to identify they just require awareness.

Ignoring the subscription data pattern is one of the most common. QIB subscription numbers released during the final days of an issue are among the most reliable institutional confidence signals available. Strong QIB subscription in a fundamentally sound IPO is a positive marker. Weak QIB participation in a heavily marketed issue should make you cautious.

Chasing GMP without reading fundamentals has led to poor outcomes for investors who applied to highly subscribed SME or mainboard IPOs that listed poorly. The grey market reflects demand, not value. Both need to align for a smart investment IPO decision.

Submitting multiple applications from the same PAN is a compliance error. SEBI rules disallow more than one HNI application per PAN in the same category. Applications can be rejected on this basis. Using separate Demat accounts across family members — each with a different PAN — is a legitimate strategy to increase allotment probability while staying within guidelines.

Having no post-listing plan is another gap. If you got allotment, what is your exit? Investors who apply without deciding in advance whether they are in for listing gains or long-term holding often make reactive decisions at opening bell — and frequently leave value on the table or hold through a correction.

Why Should You Choose Ckredence Wealth for Smart IPO Investment Guidance?

IPO investing requires good timing, but it also needs portfolio context. Knowing whether a given IPO fits your existing holdings, your risk profile, and your long-term goals is not something a subscription alert can answer.

At Ckredence Wealth, we help HNI and UHNI investors place IPOs within a broader wealth strategy not as isolated bets.

What we bring to your IPO decisions:

SEBI-registered professional advisory (Registration No. INP000007164) with 37 years of wealth management experience

IPO evaluation supported by equity research and fundamental analysis the same process our fund managers use in PMS portfolio construction

Guidance on HNI application strategy, category selection (sHNI vs bHNI), and position sizing relative to overall portfolio

Proven Wealth Management Track Record:

Client Assets: ₹700+ Crores managed with consistent focus on capital preservation and risk-adjusted returns

Active Clients: 450+ investors trusting us across PMS, mutual funds, and equity investments

Investment Approaches: 4 distinct PMS strategies covering All Weather, Diversified, Business Cycle, and ICE Growth

Your IPO investments don't exist in isolation. Ckredence Wealth helps you decide not just whether to apply, but how much to allocate and what to do after listing day.

Ready to bring structure to your investment decisions? Schedule a Consultation.

Conclusion

Smart IPO investing is not about applying to everything that opens. It is about reading the DRHP for business quality and fund usage, checking valuation against sector benchmarks, reading subscription data and GMP as supporting signals, and applying through ASBA with a clear post-listing plan in place.

DRHP fundamentals and P/E benchmarking separate high-quality issues from noise

HNI category structure under SEBI gives proportionate allotment advantages for investors applying above ₹2 lakh

GMP is a market sentiment tool, fundamentals remain the real decision driver

Portfolio-level thinking, not issue-level excitement, is what builds long-term returns from IPO investing

The IPO market rewards preparation. Investors who read the prospectus, analyze financials, and apply strategically through the right category consistently outperform those chasing headlines. At Ckredence Wealth, we help HNI investors connect IPO opportunities to their broader wealth goals because every allocation decision matters when you are building long-term capital.

FAQs

What is a smart investment in an IPO, and how is it different from regular IPO applications?

A smart investment in an IPO is based on DRHP analysis, valuation benchmarking, and portfolio fit, not just listing excitement. It is different from regular IPO because applications often rely on GMP or subscription buzz without checking the company's financial health.

How does the HNI category differ from the retail category in an IPO?

The HNI category differ from the retail category in an IPO as it requires a minimum application of ₹2 lakh and uses proportionate allotment instead of a lottery. Retail investors apply for smaller amounts and allotment is done by draw of lots if oversubscribed.

What is ASBA, and why is it required for smart IPO investment in the HNI category?

ASBA stands for Application Supported by Blocked Amount which is SEBI-mandated mechanism for all HNI IPO applications in India. It blocks funds in your bank account without transferring them until allotment.

How do you use GMP as part of a smart IPO investment decision?

You use GMP as part of a smart IPO investment decision as GMP shows informal market sentiment and potential listing direction. Use it alongside DRHP fundamentals and QIB subscription data not as a standalone signal. High GMP without fundamental backing has resulted in below-issue-price listings in multiple past cases.

India's IPO market has grown into one of the most active in the world. According to PRIME Database, Indian companies raised over ₹2,11,151 crore through IPOs, follow-on offers, and offers for sale in 2024. This was the highest ever recorded in a single calendar year.

Is every IPO that opens worth your money, or are most of them just noise?

What does the DRHP actually tell you before you put your capital on the line?

How do investors with similar profiles walk away with very different outcomes from the same IPO?

For investors who want more than just a lucky allotment, a smart investment IPO approach begins long before the bidding window opens. It starts with a clear-eyed reading of the fundamentals, an honest look at valuation, and a decision about how this issue fits into the broader portfolio.

This guide covers each of those steps from DRHP evaluation to post-listing planning. You can stop reacting to IPO hype and start making decisions backed by real analysis.

Key Takeaways

Check the DRHP "Objects of the Issue" section to see if funds go toward growth or investor exits

HNI/NII category gives proportionate allotment for investments above ₹10 lakhs instead of retail lottery

Grey Market Premium shows sentiment, not guarantees high GMP without strong fundamentals often leads to weak listing gains

QIB subscription levels reliably indicate institutional confidence in an IPO

ASBA keeps funds in your account until allotment, reducing opportunity cost

Applying through family members' separate Demat accounts legally improves allotment chances in sHNI category

Plan ahead: decide whether to book listing profits or hold long-term based on company fundamentals

What Makes an IPO a Smart Investment?

Not every IPO deserves your capital. The difference between a smart investment IPO and a reactive one lies in how much homework you do before the issue opens.

A company going public is essentially asking investors to fund its next chapter. The question you need to answer is whether that next chapter is worth funding. To do that well, you need to look at three things: where the money is going, what the business looks like financially, and whether the price is fair given industry comparables.

The three filters for every IPO:

1. Growth Intent vs. Exit Intent Check the "Objects of the Issue" in the DRHP. If most of the funds raised go toward expansion, R&D, or debt reduction for productive assets, that is a growth-oriented IPO. If a large chunk goes toward an Offer for Sale (OFS), existing shareholders, promoters or PE investors are cashing out. This doesn't make the IPO bad by default, but it changes what you are buying into.

2. Revenue and Profit Trend Look at three years of revenue, EBITDA, and PAT data. A company with shrinking margins or inconsistent profits going into an IPO at high valuations is a red flag. Strong businesses typically show consistent top-line growth with improving or stable margins.

3. Price-to-Earnings Relative to Listed Peers Compare the IPO's P/E ratio against companies already listed in the same sector. If the IPO is priced at a steep premium to the sector average without a clear reason higher growth rate, unique positioning, market leadership the valuation is a concern. Overpriced issues tend to list flat or below issue price.

These three filters alone will help you move past the noise and focus on issues worth your time and capital. The next step is going deeper into the DRHP.

How to Read the DRHP Before Every Smart IPO Investment

The Draft Red Herring Prospectus is the most information-dense document available for any IPO. Most investors skip it. The ones who read it are usually better prepared for what happens post-listing.

The DRHP is filed with SEBI before the IPO opens. It is publicly available on the SEBI website and the company's website. Reading it fully can take a few hours, but there are specific sections that give you the most useful signals quickly.

The "Risk Factors" Section

This section is written by the company's lawyers and describes every material risk they are legally required to disclose. Read it with intent. Recurring mentions of regulatory exposure, litigation, client concentration, or promoter-related issues are things to weigh seriously. A long risk section doesn't mean a bad company — but a pattern of the same risks appearing in multiple forms is a signal.

Financial Statements and Restated Accounts

Look at the restated financials, not just the current year. Sudden profitability just before the IPO filing especially after years of losses can indicate earnings management. Check if the company consistently converts revenue into cash by reviewing operating cash flow against reported profits.

Promoter Background and Shareholding

A promoter with a strong track record in the same sector, holding a significant stake post-IPO, signals confidence. Heavy dilution by promoters at IPO stage is worth questioning. Also review the lock-in period for promoter shares when they are free to sell matters for long-term price stability.

Understanding the DRHP is only one part of the picture. What the grey market says about an IPO before listing adds a different layer of insight one that carries its own limitations.

Understanding Grey Market Premium in Smart IPO Investing

The Grey Market Premium, or GMP, is the unofficial price at which IPO shares trade before they are listed on stock exchanges. It reflects what buyers in informal markets are willing to pay above the issue price based on early demand signals.

GMP is not regulated by SEBI and operates outside formal market infrastructure. It is sourced from dealer networks and informal channels. As a result, it is speculative by nature and should not be the primary basis for any IPO investment decision.

What GMP Actually Measures

A high GMP means strong demand exists in informal markets. It often correlates with high subscription numbers and positive listing days but not always. There have been well-known cases where IPOs with very high GMP listed below issue price because the fundamental case didn't support the sentiment.

When GMP Is Useful And When It Isn't

GMP is a useful cross-reference tool, not a decision driver. When a high GMP is backed by strong subscription data, solid fundamentals, and reasonable valuation, it adds confidence to an already well-researched position.

When GMP is high but the DRHP shows weak fundamentals or stretched valuations, the grey market is usually pricing in short-term listing momentum — not business value. Treat it as one data point, not the final word.

IPO Categories in India: Where HNI Investors Fit

Every mainboard IPO in India is divided into three investor categories: Retail Individual Investors (RII), Non-Institutional Investors (NII/HNI), and Qualified Institutional Buyers (QIB). Each category has its own allocation, rules, and allotment process.

Under current SEBI guidelines, the sHNI category does not use a proportionate allotment system during oversubscription; it has shifted to a lottery-based system similar to the retail category.

sHNI - Small HNI (₹2 Lakh to ₹10 Lakh)

Allocation: One-third (1/3rd) of the total NII quota.

Allotment Method: If oversubscribed, allotment is done via a computerised lottery system, not proportionately. Winners in this lottery receive the full minimum application size (shares worth roughly ₹2 lakh).

Odds: While it is a lottery, it often has lower oversubscription levels than the Retail category, which can offer mathematically better odds for some investors.

bHNI - Big HNI (Above ₹10 Lakh)

Allocation: Two-thirds (2/3rd) of the total NII quota.

Allotment Method: Typically follows proportionate allotment for oversubscribed issues. However, recent rules ensure that every successful applicant first receives at least one minimum lot before the remaining shares are distributed pro-rata.

How to Apply for an IPO Using ASBA Step-by-Step

For HNI investors, Application Supported by Blocked Amount (ASBA) is the standard SEBI-approved method for IPO applications. The amount is blocked in your bank account and only debited on allotment day. Non-allotted funds are released automatically.

The steps involved are:

Check eligibility - Confirm you have an active Demat and trading account with a broker that supports IPO applications and HNI bids above ₹2 lakh.

Complete KYC and link your bank - Your PAN, Demat account, and ASBA-linked bank account must all be in order before applying.

Review the issue details - Check the IPO opening and closing dates, price band, lot size, and NII allocation from the prospectus or your broker platform.

Submit your ASBA application - Log into your net banking or broker portal, go to IPO Application, select the NII/HNI category, enter the number of lots, and bid at the upper end of the price band. HNIs cannot bid at cut-off price.

Track allotment status - After the issue closes, check allotment on the registrar's website or NSE India. Blocked funds are released within a few business days for non-allotted applications.

A practical note: Most banks stop accepting HNI ASBA applications by 2:00 PM to 3:00 PM on the last day of bidding. Retail investors often get until 4:00 PM. Do not wait until the last hour if you are applying in the HNI category.

Common Mistakes That Turn Smart IPO Investments Into Losses

Even investors who research well sometimes make avoidable errors in execution. These mistakes don't require complex analysis to identify they just require awareness.

Ignoring the subscription data pattern is one of the most common. QIB subscription numbers released during the final days of an issue are among the most reliable institutional confidence signals available. Strong QIB subscription in a fundamentally sound IPO is a positive marker. Weak QIB participation in a heavily marketed issue should make you cautious.

Chasing GMP without reading fundamentals has led to poor outcomes for investors who applied to highly subscribed SME or mainboard IPOs that listed poorly. The grey market reflects demand, not value. Both need to align for a smart investment IPO decision.

Submitting multiple applications from the same PAN is a compliance error. SEBI rules disallow more than one HNI application per PAN in the same category. Applications can be rejected on this basis. Using separate Demat accounts across family members — each with a different PAN — is a legitimate strategy to increase allotment probability while staying within guidelines.

Having no post-listing plan is another gap. If you got allotment, what is your exit? Investors who apply without deciding in advance whether they are in for listing gains or long-term holding often make reactive decisions at opening bell — and frequently leave value on the table or hold through a correction.

Why Should You Choose Ckredence Wealth for Smart IPO Investment Guidance?

IPO investing requires good timing, but it also needs portfolio context. Knowing whether a given IPO fits your existing holdings, your risk profile, and your long-term goals is not something a subscription alert can answer.

At Ckredence Wealth, we help HNI and UHNI investors place IPOs within a broader wealth strategy not as isolated bets.

What we bring to your IPO decisions:

SEBI-registered professional advisory (Registration No. INP000007164) with 37 years of wealth management experience

IPO evaluation supported by equity research and fundamental analysis the same process our fund managers use in PMS portfolio construction

Guidance on HNI application strategy, category selection (sHNI vs bHNI), and position sizing relative to overall portfolio

Proven Wealth Management Track Record:

Client Assets: ₹700+ Crores managed with consistent focus on capital preservation and risk-adjusted returns

Active Clients: 450+ investors trusting us across PMS, mutual funds, and equity investments

Investment Approaches: 4 distinct PMS strategies covering All Weather, Diversified, Business Cycle, and ICE Growth

Your IPO investments don't exist in isolation. Ckredence Wealth helps you decide not just whether to apply, but how much to allocate and what to do after listing day.

Ready to bring structure to your investment decisions? Schedule a Consultation.

Conclusion

Smart IPO investing is not about applying to everything that opens. It is about reading the DRHP for business quality and fund usage, checking valuation against sector benchmarks, reading subscription data and GMP as supporting signals, and applying through ASBA with a clear post-listing plan in place.

DRHP fundamentals and P/E benchmarking separate high-quality issues from noise

HNI category structure under SEBI gives proportionate allotment advantages for investors applying above ₹2 lakh

GMP is a market sentiment tool, fundamentals remain the real decision driver

Portfolio-level thinking, not issue-level excitement, is what builds long-term returns from IPO investing

The IPO market rewards preparation. Investors who read the prospectus, analyze financials, and apply strategically through the right category consistently outperform those chasing headlines. At Ckredence Wealth, we help HNI investors connect IPO opportunities to their broader wealth goals because every allocation decision matters when you are building long-term capital.

FAQs

What is a smart investment in an IPO, and how is it different from regular IPO applications?

A smart investment in an IPO is based on DRHP analysis, valuation benchmarking, and portfolio fit, not just listing excitement. It is different from regular IPO because applications often rely on GMP or subscription buzz without checking the company's financial health.

How does the HNI category differ from the retail category in an IPO?

The HNI category differ from the retail category in an IPO as it requires a minimum application of ₹2 lakh and uses proportionate allotment instead of a lottery. Retail investors apply for smaller amounts and allotment is done by draw of lots if oversubscribed.

What is ASBA, and why is it required for smart IPO investment in the HNI category?

ASBA stands for Application Supported by Blocked Amount which is SEBI-mandated mechanism for all HNI IPO applications in India. It blocks funds in your bank account without transferring them until allotment.

How do you use GMP as part of a smart IPO investment decision?

You use GMP as part of a smart IPO investment decision as GMP shows informal market sentiment and potential listing direction. Use it alongside DRHP fundamentals and QIB subscription data not as a standalone signal. High GMP without fundamental backing has resulted in below-issue-price listings in multiple past cases.