6 Min Read

6 Min Read

Why Portfolio Management Matters: Objectives, Benefits, and the Right Approach for Indian Investors

Why Portfolio Management Matters: Objectives, Benefits, and the Right Approach for Indian Investors

Why Portfolio Management Matters: Objectives, Benefits, and the Right Approach for Indian Investors

Portfolio management aligns your investments with financial goals through diversification, risk control, and expert oversight — here's why it matters.

Portfolio management aligns your investments with financial goals through diversification, risk control, and expert oversight — here's why it matters.

Portfolio management aligns your investments with financial goals through diversification, risk control, and expert oversight — here's why it matters.

Ckredence Wealth

Ckredence Wealth

|

February 14, 2026

February 14, 2026

India's investment participation has grown faster in the last five years than in the previous two decades. As of February 2025, retail investor registrations on NSE crossed 11.2 crore — a number that reflects a major shift in how Indians approach wealth building (Source: NSE India). Yet the data alongside this growth tells a less comfortable story: only 38% of Indian investors actively compare their portfolio performance against a benchmark like Nifty 50 or Sensex (Source: 2024 SurveyMonkey Poll). Most Indians are investing. Far fewer are managing what they invest.

Are your investments spread across multiple assets, or concentrated in 2–3 places without you realising it?

Do you know whether your current portfolio actually reflects your financial goals — retirement, education, or long-term wealth transfer?

Has your portfolio been reviewed and rebalanced in the last 12 months, or has it simply drifted with the market?

The gap between investing and actively managing investments is where financial outcomes are decided. This article examines what portfolio management means as a discipline, why it matters at every stage of wealth building, and when professional management becomes the right answer for serious investors.

Key Takeaways

Portfolio management ≠ investing. One is a transaction. The other is an ongoing discipline.

Diversification across asset classes stops one bad market from damaging your entire corpus.

Risk tolerance, income, and investment horizon must shape every allocation decision.

Portfolios drift over time. Without rebalancing, your actual risk quietly increases.

Unmanaged portfolios cost more than missed returns — they cost tax, liquidity, and goal alignment.

Tax-efficient exit planning within a managed portfolio protects net returns over the long term.

Professional management replaces emotion-led, reactive investing with a repeatable process.

What Is Portfolio Management?

Portfolio management is the ongoing process of selecting, organising, and reviewing a mix of investments to meet financial goals while balancing risk and return. It is both analytical — driven by data, market research, and fundamental analysis — and judgment-based, requiring experience, timing, and the ability to adapt to changing conditions.

Most investors treat their portfolio as a collection of financial products. Portfolio management treats it as a system — one where every asset has a defined role, a target allocation, and a scheduled review.

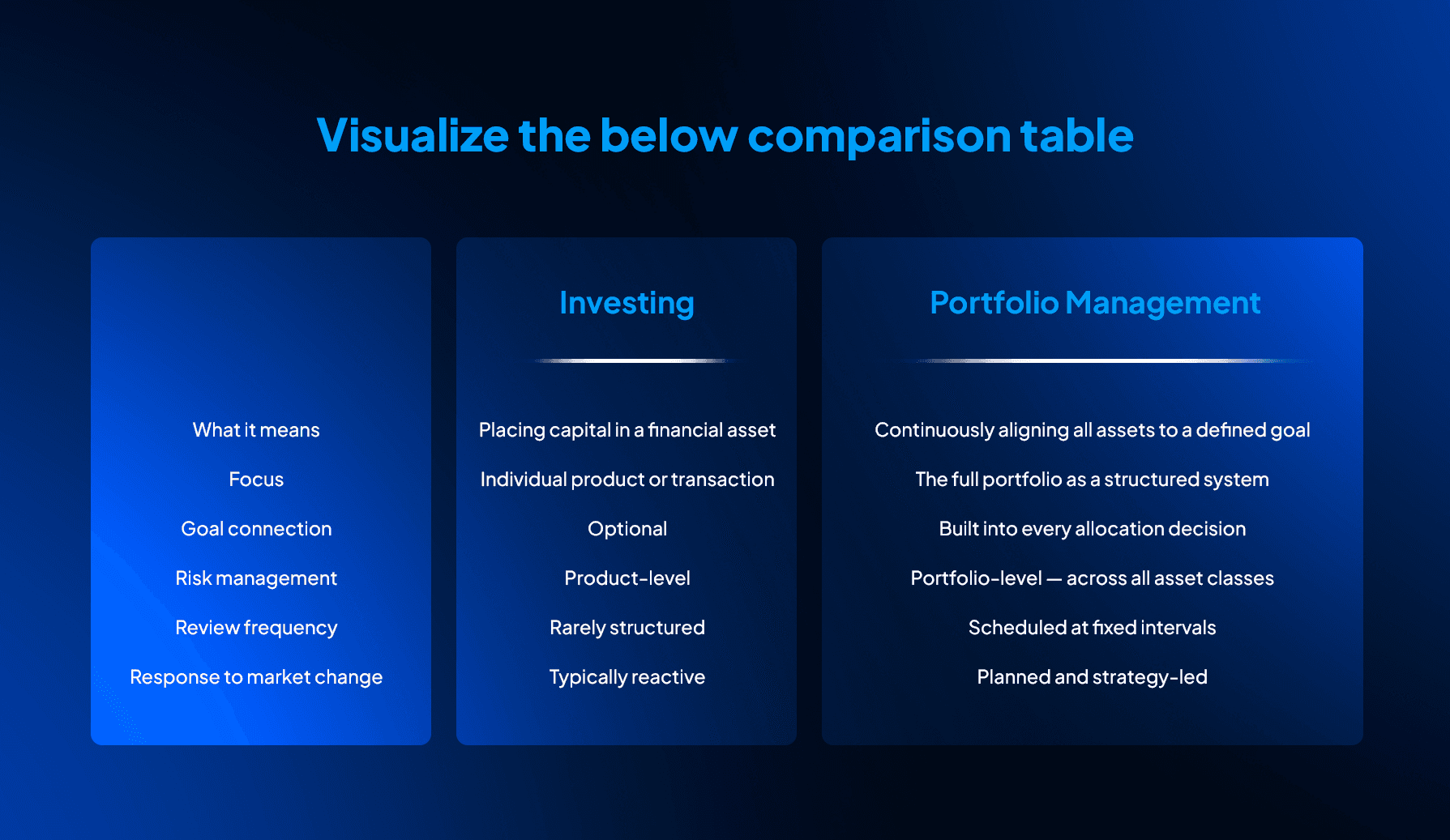

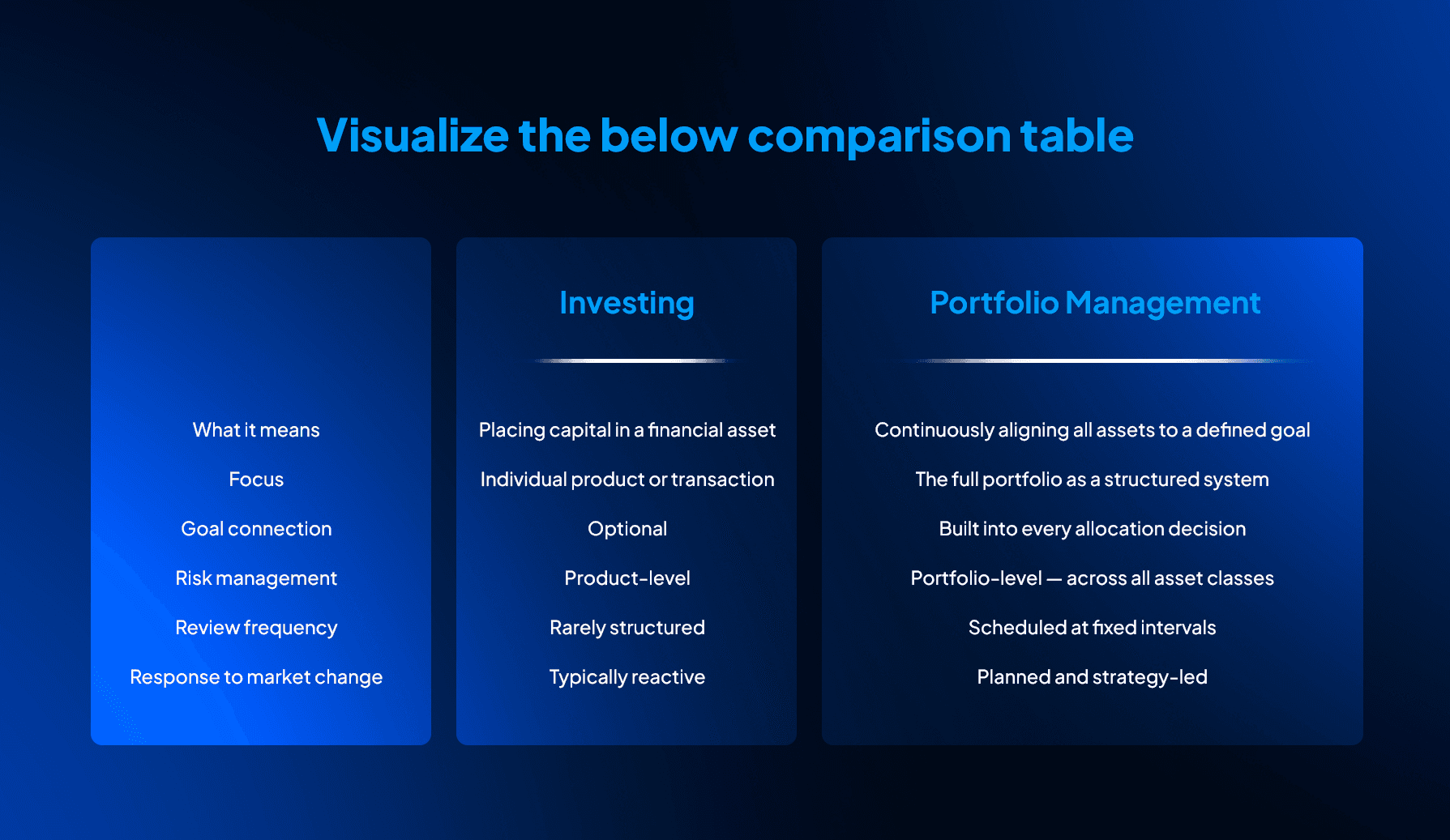

Portfolio Management vs. Simply Investing

Both investing and portfolio management involve putting money to work, but they operate at completely different levels. One is a single decision. The other is an ongoing discipline built around what that decision is meant to achieve.

Most investors are doing the left column. Portfolio management asks you to operate from the right. For investors evaluating a formal, professionally managed approach, our detailed guide on Portfolio Management Services in India covers eligibility, types, charges, and SEBI regulations in full.

Why Is Portfolio Management Important?

The importance of portfolio management shows up in real financial outcomes — in how much risk an investor actually carries, how much tax they pay on gains, and whether their money is working toward a goal or simply working. Each reason below connects to a specific, measurable outcome that structured portfolio management changes.

Without this connection between investment decisions and a defined purpose, even a broadly spread portfolio can drift away from what an investor actually needs from their wealth.

1. Risk Mitigation Through Diversification

Spreading investments across asset classes — equity, debt, gold, real estate — prevents any single market event from collapsing the full portfolio. This is the discipline's first line of defence against concentration risk. India's equity markets can move 10–15% within a single quarter, which makes cross-asset thinking a basic requirement, not an advanced strategy.

A single underperforming sector causes limited damage in a well-allocated portfolio. The same event can set back an undiversified investor significantly. That difference is the most measurable benefit of active portfolio management.

2. Goal Alignment Across Time Horizons

Different financial goals need different asset allocations and different timelines. A retirement corpus being built over 20 years can absorb equity risk. A down payment for a property needed in 18 months cannot.

Portfolio management maps each rupee to a purpose — wealth creation, children's education, business capital, or legacy planning. This mapping prevents the common problem of short-term capital trapped in long-term instruments and long-term goals funded by assets that can't grow fast enough.

3. Tax-Efficient Wealth Building

Portfolio structure directly influences the tax an investor pays on gains. Long-term capital gains on equity are taxed at 12.5% for amounts above ₹1.25 lakh annually. Short-term capital gains are taxed at 20%. Unmanaged, fear-driven exits frequently trigger the higher rate at the worst possible moment.

A managed portfolio plans exits with tax efficiency in mind. Loss harvesting — selling underperforming holdings to offset taxable gains — is a standard tool within professionally managed portfolios. Over a long investment horizon, this planning makes a real difference to what actually reaches the investor's account.

4. Continuous Monitoring Prevents Drift

A portfolio built with a 60% equity and 40% debt allocation does not stay that way on its own. After a strong equity bull run, that split can quietly shift to 75/25 — increasing risk beyond what the investor originally agreed to carry.

Regular monitoring identifies when drift has occurred. Rebalancing corrects it by selling a portion of the outperforming asset and adding to the underperforming one to restore the original structure. This keeps the portfolio honest to its stated risk profile.

5. Professional Expertise as a Compounding Advantage

A fund manager with decades of market experience brings more than stock-picking ability. They bring knowledge of how different market cycles behave, how sectors rotate, and how macroeconomic events affect specific asset classes in India's context. This judgment compounds alongside the portfolio itself.

For investors managing large capital, this expertise becomes the difference between returns that match the market and returns that consistently beat it. Portfolio Management Services (PMS) in India are the formal, SEBI-regulated framework through which this professional expertise is applied to individual portfolios — tailored to each investor's capital appreciation goals, income needs, or a combination of both based on their risk appetite.

What Makes a Portfolio Well-Managed?

A well-managed portfolio is not one that simply delivered strong returns last year. Returns are partly a function of market conditions. A well-managed portfolio performs its role — protecting capital, building wealth, and staying aligned with goals — across different market conditions, not just favourable ones.

Most investors have pieces of good portfolio management in place by chance. A well-managed portfolio has all of them by design.

Four markers that define a well-managed portfolio:

Goal Alignment: Every asset connects to a defined financial objective with a clear timeline. There are no investments in the portfolio without a stated purpose.

Defined Asset Allocation: A target split across equity, debt, and alternatives is set from the start and maintained deliberately — not left to drift as markets move.

Documented Risk Parameters: The investor's risk tolerance is formally assessed and reflected in how the portfolio is built. This assessment is revisited as income, age, and responsibilities change.

Review Cadence: The portfolio is assessed at fixed intervals against a relevant benchmark. Reviews happen on a calendar, not in reaction to market panic.

The absence of even one of these markers creates gaps that grow quietly over time. Understanding what those gaps actually cost is the step most investors skip entirely.

The Cost of Not Managing Your Portfolio

Most of the conversation around portfolio management focuses on what it delivers. The other side — what unmanaged investing costs — gets far less attention. For many investors, the losses from not managing are larger over time than the gains from picking a good stock or fund.

These are not abstract risks. They appear in real portfolios in three specific and predictable ways.

1. Concentration Risk Accumulating Silently

The most common version of this problem: an investor holds 60–70% of their total wealth across just two or three assets — typically domestic equity, a property, and fixed deposits. Each asset feels diversified in isolation. Together, they carry significant correlated risk in a slowing economy.

Most investors do not realise this imbalance exists until a correction affects all three at once. By then, the options available to respond are limited.

2. Goal Misalignment Growing Over Time

When a portfolio is not reviewed, time horizons get mismatched. Capital meant for a short-term goal — a property down payment, a business expense, a child's admission fee — often sits in long-duration investments. When the need arises, the investor is either forced to exit at a loss or simply unable to access funds.

This problem is entirely preventable with a structured review process. It is also nearly universal in self-managed portfolios that lack formal oversight.

3. Tax Drag from Unplanned Exits

Without a managed approach, investors typically sell when markets fall sharply — reacting to fear rather than following a plan. These exits, made outside a tax framework, often trigger short-term capital gains tax at 20%. A planned exit under the same market conditions, timed with the holding period and loss harvesting in mind, can reduce this cost in a real, measurable way.

Over a 10–15 year investment horizon, the cumulative tax saved through structured portfolio management adds up to a meaningful number — one that unmanaged investors consistently leave behind.

Who Needs Professional Portfolio Management?

Portfolio management as a discipline applies to any investor with more than one financial asset and at least one financial goal. But professional portfolio management — where a qualified fund manager takes responsibility — becomes relevant at a specific point in an investor's financial journey.

The question is not only how much capital you have. It is about how complex your financial life has become and how much attention your portfolio actually requires.

Investors who benefit most from professional management:

Investors with ₹25 lakh+ in investible assets who have moved past basic mutual funds and need structured allocation across multiple asset classes

Busy professionals — doctors, chartered accountants, business owners — who lack the time to track portfolio decisions and market movements on a daily basis

Pre-retirement investors (aged 45–60) who need to shift from growth-first investing to capital preservation without giving up growth potential entirely

First-generation wealth builders transitioning from single-instrument investing — FDs, real estate — to a multi-asset, goal-based portfolio structure

NRIs with India-based investments who need tax treaty-aware, SEBI-compliant management through NRO/NRE accounts, a need addressed in detail through PMS for NRI investors

The common thread across all these profiles is not a wealth threshold. It is the need for an intentional, goal-driven structure that removes emotion from investment decisions and replaces it with process. For HNIs specifically evaluating SEBI-regulated Portfolio Management Services, our detailed guide on PMS in India covers eligibility, types, charges, and SEBI regulations in full.

Why Should You Choose Credence Wealth?

Portfolio management done well requires more than market knowledge. It requires consistency across market cycles, a clear investment philosophy, and the discipline to stay with a strategy when short-term noise creates pressure to react. These qualities are built over years of real market experience — and Ckredence Wealth has been building and managing portfolios across bull runs, corrections, and economic cycles since 1987.

That is 37 years of structured investment experience in Indian markets. It is also the foundation on which every portfolio we build for our clients today is designed.

Solutions That Matter:

SEBI-registered professional management (INP000007164) with four distinct investment approaches — All Weather, Diversified, Business Cycle, and ICE Growth — each designed for different market conditions and investor goals

₹805+ Crore AUM across 376+ active clients — consistent client trust built across market cycles, not just strong performance in a single year

Monthly market insights by CIO Kartik Mehta (20+ years of experience) — portfolio decisions explained with full context so clients understand the reasoning, not just the outcome

Dedicated NRI Desk for overseas investors managing India-based portfolio allocations with full SEBI and RBI compliance

Transparent fee structures — fixed and performance-based options aligned to client outcomes, with no hidden charges

Your investments deserve a plan built around your goals, your risk capacity, and your timeline — not a standard product fitted to a general profile. Talk to our advisors to understand how professional portfolio management can be structured specifically for your situation.

Conclusion

Portfolio management is the discipline that separates purposeful wealth building from reactive investing. When practised consistently, it aligns every investment to a goal, keeps risk within defined limits, and builds wealth that grows with intention rather than fluctuates with sentiment.

Goal-aligned portfolios deliver more consistent outcomes than unstructured collections of investments over long investment horizons

Risk profiling and regular rebalancing are the two highest-impact, least-practised elements of portfolio management among Indian investors today

Tax planning within a managed portfolio framework protects the net returns that unplanned exits quietly reduce over time

For investors with growing capital, professional portfolio management is not an optional upgrade — it is the structure that protects what has already been built and gives what comes next a clear direction

FAQs

What is the importance of portfolio management for investors in India?

Portfolio management aligns investments with specific financial goals and risk capacity. It prevents concentration risk by spreading capital across asset classes. This structure protects wealth during market downturns while keeping growth exposure active over the long term.

What is the difference between investing and portfolio management?

Investing is placing capital in financial assets like stocks or mutual funds. Portfolio management is the ongoing process of reviewing and rebalancing those investments toward a defined goal. The key difference is that portfolio management connects every rupee to a purpose.

When should an investor consider professional portfolio management?

Professional portfolio management becomes relevant when managing capital across multiple goals and asset classes. Investors with growing assets, complex tax needs, or limited time benefit most from professional oversight. Portfolio Management Services (PMS) in India serve this need for HNIs with ₹50 lakh or more.

How does portfolio rebalancing help in long-term wealth creation?

Portfolio rebalancing restores the original asset allocation when market movements shift the mix. It prevents any single asset class from carrying more risk than the investor planned to take. Regular rebalancing keeps the portfolio aligned with goals rather than with market momentum.

India's investment participation has grown faster in the last five years than in the previous two decades. As of February 2025, retail investor registrations on NSE crossed 11.2 crore — a number that reflects a major shift in how Indians approach wealth building (Source: NSE India). Yet the data alongside this growth tells a less comfortable story: only 38% of Indian investors actively compare their portfolio performance against a benchmark like Nifty 50 or Sensex (Source: 2024 SurveyMonkey Poll). Most Indians are investing. Far fewer are managing what they invest.

Are your investments spread across multiple assets, or concentrated in 2–3 places without you realising it?

Do you know whether your current portfolio actually reflects your financial goals — retirement, education, or long-term wealth transfer?

Has your portfolio been reviewed and rebalanced in the last 12 months, or has it simply drifted with the market?

The gap between investing and actively managing investments is where financial outcomes are decided. This article examines what portfolio management means as a discipline, why it matters at every stage of wealth building, and when professional management becomes the right answer for serious investors.

Key Takeaways

Portfolio management ≠ investing. One is a transaction. The other is an ongoing discipline.

Diversification across asset classes stops one bad market from damaging your entire corpus.

Risk tolerance, income, and investment horizon must shape every allocation decision.

Portfolios drift over time. Without rebalancing, your actual risk quietly increases.

Unmanaged portfolios cost more than missed returns — they cost tax, liquidity, and goal alignment.

Tax-efficient exit planning within a managed portfolio protects net returns over the long term.

Professional management replaces emotion-led, reactive investing with a repeatable process.

What Is Portfolio Management?

Portfolio management is the ongoing process of selecting, organising, and reviewing a mix of investments to meet financial goals while balancing risk and return. It is both analytical — driven by data, market research, and fundamental analysis — and judgment-based, requiring experience, timing, and the ability to adapt to changing conditions.

Most investors treat their portfolio as a collection of financial products. Portfolio management treats it as a system — one where every asset has a defined role, a target allocation, and a scheduled review.

Portfolio Management vs. Simply Investing

Both investing and portfolio management involve putting money to work, but they operate at completely different levels. One is a single decision. The other is an ongoing discipline built around what that decision is meant to achieve.

Most investors are doing the left column. Portfolio management asks you to operate from the right. For investors evaluating a formal, professionally managed approach, our detailed guide on Portfolio Management Services in India covers eligibility, types, charges, and SEBI regulations in full.

Why Is Portfolio Management Important?

The importance of portfolio management shows up in real financial outcomes — in how much risk an investor actually carries, how much tax they pay on gains, and whether their money is working toward a goal or simply working. Each reason below connects to a specific, measurable outcome that structured portfolio management changes.

Without this connection between investment decisions and a defined purpose, even a broadly spread portfolio can drift away from what an investor actually needs from their wealth.

1. Risk Mitigation Through Diversification

Spreading investments across asset classes — equity, debt, gold, real estate — prevents any single market event from collapsing the full portfolio. This is the discipline's first line of defence against concentration risk. India's equity markets can move 10–15% within a single quarter, which makes cross-asset thinking a basic requirement, not an advanced strategy.

A single underperforming sector causes limited damage in a well-allocated portfolio. The same event can set back an undiversified investor significantly. That difference is the most measurable benefit of active portfolio management.

2. Goal Alignment Across Time Horizons

Different financial goals need different asset allocations and different timelines. A retirement corpus being built over 20 years can absorb equity risk. A down payment for a property needed in 18 months cannot.

Portfolio management maps each rupee to a purpose — wealth creation, children's education, business capital, or legacy planning. This mapping prevents the common problem of short-term capital trapped in long-term instruments and long-term goals funded by assets that can't grow fast enough.

3. Tax-Efficient Wealth Building

Portfolio structure directly influences the tax an investor pays on gains. Long-term capital gains on equity are taxed at 12.5% for amounts above ₹1.25 lakh annually. Short-term capital gains are taxed at 20%. Unmanaged, fear-driven exits frequently trigger the higher rate at the worst possible moment.

A managed portfolio plans exits with tax efficiency in mind. Loss harvesting — selling underperforming holdings to offset taxable gains — is a standard tool within professionally managed portfolios. Over a long investment horizon, this planning makes a real difference to what actually reaches the investor's account.

4. Continuous Monitoring Prevents Drift

A portfolio built with a 60% equity and 40% debt allocation does not stay that way on its own. After a strong equity bull run, that split can quietly shift to 75/25 — increasing risk beyond what the investor originally agreed to carry.

Regular monitoring identifies when drift has occurred. Rebalancing corrects it by selling a portion of the outperforming asset and adding to the underperforming one to restore the original structure. This keeps the portfolio honest to its stated risk profile.

5. Professional Expertise as a Compounding Advantage

A fund manager with decades of market experience brings more than stock-picking ability. They bring knowledge of how different market cycles behave, how sectors rotate, and how macroeconomic events affect specific asset classes in India's context. This judgment compounds alongside the portfolio itself.

For investors managing large capital, this expertise becomes the difference between returns that match the market and returns that consistently beat it. Portfolio Management Services (PMS) in India are the formal, SEBI-regulated framework through which this professional expertise is applied to individual portfolios — tailored to each investor's capital appreciation goals, income needs, or a combination of both based on their risk appetite.

What Makes a Portfolio Well-Managed?

A well-managed portfolio is not one that simply delivered strong returns last year. Returns are partly a function of market conditions. A well-managed portfolio performs its role — protecting capital, building wealth, and staying aligned with goals — across different market conditions, not just favourable ones.

Most investors have pieces of good portfolio management in place by chance. A well-managed portfolio has all of them by design.

Four markers that define a well-managed portfolio:

Goal Alignment: Every asset connects to a defined financial objective with a clear timeline. There are no investments in the portfolio without a stated purpose.

Defined Asset Allocation: A target split across equity, debt, and alternatives is set from the start and maintained deliberately — not left to drift as markets move.

Documented Risk Parameters: The investor's risk tolerance is formally assessed and reflected in how the portfolio is built. This assessment is revisited as income, age, and responsibilities change.

Review Cadence: The portfolio is assessed at fixed intervals against a relevant benchmark. Reviews happen on a calendar, not in reaction to market panic.

The absence of even one of these markers creates gaps that grow quietly over time. Understanding what those gaps actually cost is the step most investors skip entirely.

The Cost of Not Managing Your Portfolio

Most of the conversation around portfolio management focuses on what it delivers. The other side — what unmanaged investing costs — gets far less attention. For many investors, the losses from not managing are larger over time than the gains from picking a good stock or fund.

These are not abstract risks. They appear in real portfolios in three specific and predictable ways.

1. Concentration Risk Accumulating Silently

The most common version of this problem: an investor holds 60–70% of their total wealth across just two or three assets — typically domestic equity, a property, and fixed deposits. Each asset feels diversified in isolation. Together, they carry significant correlated risk in a slowing economy.

Most investors do not realise this imbalance exists until a correction affects all three at once. By then, the options available to respond are limited.

2. Goal Misalignment Growing Over Time

When a portfolio is not reviewed, time horizons get mismatched. Capital meant for a short-term goal — a property down payment, a business expense, a child's admission fee — often sits in long-duration investments. When the need arises, the investor is either forced to exit at a loss or simply unable to access funds.

This problem is entirely preventable with a structured review process. It is also nearly universal in self-managed portfolios that lack formal oversight.

3. Tax Drag from Unplanned Exits

Without a managed approach, investors typically sell when markets fall sharply — reacting to fear rather than following a plan. These exits, made outside a tax framework, often trigger short-term capital gains tax at 20%. A planned exit under the same market conditions, timed with the holding period and loss harvesting in mind, can reduce this cost in a real, measurable way.

Over a 10–15 year investment horizon, the cumulative tax saved through structured portfolio management adds up to a meaningful number — one that unmanaged investors consistently leave behind.

Who Needs Professional Portfolio Management?

Portfolio management as a discipline applies to any investor with more than one financial asset and at least one financial goal. But professional portfolio management — where a qualified fund manager takes responsibility — becomes relevant at a specific point in an investor's financial journey.

The question is not only how much capital you have. It is about how complex your financial life has become and how much attention your portfolio actually requires.

Investors who benefit most from professional management:

Investors with ₹25 lakh+ in investible assets who have moved past basic mutual funds and need structured allocation across multiple asset classes

Busy professionals — doctors, chartered accountants, business owners — who lack the time to track portfolio decisions and market movements on a daily basis

Pre-retirement investors (aged 45–60) who need to shift from growth-first investing to capital preservation without giving up growth potential entirely

First-generation wealth builders transitioning from single-instrument investing — FDs, real estate — to a multi-asset, goal-based portfolio structure

NRIs with India-based investments who need tax treaty-aware, SEBI-compliant management through NRO/NRE accounts, a need addressed in detail through PMS for NRI investors

The common thread across all these profiles is not a wealth threshold. It is the need for an intentional, goal-driven structure that removes emotion from investment decisions and replaces it with process. For HNIs specifically evaluating SEBI-regulated Portfolio Management Services, our detailed guide on PMS in India covers eligibility, types, charges, and SEBI regulations in full.

Why Should You Choose Credence Wealth?

Portfolio management done well requires more than market knowledge. It requires consistency across market cycles, a clear investment philosophy, and the discipline to stay with a strategy when short-term noise creates pressure to react. These qualities are built over years of real market experience — and Ckredence Wealth has been building and managing portfolios across bull runs, corrections, and economic cycles since 1987.

That is 37 years of structured investment experience in Indian markets. It is also the foundation on which every portfolio we build for our clients today is designed.

Solutions That Matter:

SEBI-registered professional management (INP000007164) with four distinct investment approaches — All Weather, Diversified, Business Cycle, and ICE Growth — each designed for different market conditions and investor goals

₹805+ Crore AUM across 376+ active clients — consistent client trust built across market cycles, not just strong performance in a single year

Monthly market insights by CIO Kartik Mehta (20+ years of experience) — portfolio decisions explained with full context so clients understand the reasoning, not just the outcome

Dedicated NRI Desk for overseas investors managing India-based portfolio allocations with full SEBI and RBI compliance

Transparent fee structures — fixed and performance-based options aligned to client outcomes, with no hidden charges

Your investments deserve a plan built around your goals, your risk capacity, and your timeline — not a standard product fitted to a general profile. Talk to our advisors to understand how professional portfolio management can be structured specifically for your situation.

Conclusion

Portfolio management is the discipline that separates purposeful wealth building from reactive investing. When practised consistently, it aligns every investment to a goal, keeps risk within defined limits, and builds wealth that grows with intention rather than fluctuates with sentiment.

Goal-aligned portfolios deliver more consistent outcomes than unstructured collections of investments over long investment horizons

Risk profiling and regular rebalancing are the two highest-impact, least-practised elements of portfolio management among Indian investors today

Tax planning within a managed portfolio framework protects the net returns that unplanned exits quietly reduce over time

For investors with growing capital, professional portfolio management is not an optional upgrade — it is the structure that protects what has already been built and gives what comes next a clear direction

FAQs

What is the importance of portfolio management for investors in India?

Portfolio management aligns investments with specific financial goals and risk capacity. It prevents concentration risk by spreading capital across asset classes. This structure protects wealth during market downturns while keeping growth exposure active over the long term.

What is the difference between investing and portfolio management?

Investing is placing capital in financial assets like stocks or mutual funds. Portfolio management is the ongoing process of reviewing and rebalancing those investments toward a defined goal. The key difference is that portfolio management connects every rupee to a purpose.

When should an investor consider professional portfolio management?

Professional portfolio management becomes relevant when managing capital across multiple goals and asset classes. Investors with growing assets, complex tax needs, or limited time benefit most from professional oversight. Portfolio Management Services (PMS) in India serve this need for HNIs with ₹50 lakh or more.

How does portfolio rebalancing help in long-term wealth creation?

Portfolio rebalancing restores the original asset allocation when market movements shift the mix. It prevents any single asset class from carrying more risk than the investor planned to take. Regular rebalancing keeps the portfolio aligned with goals rather than with market momentum.