7 Min Read

7 Min Read

Custodian in Mutual Fund: Meaning, Role, and Importance for Investors in India

Custodian in Mutual Fund: Meaning, Role, and Importance for Investors in India

Custodian in Mutual Fund: Meaning, Role, and Importance for Investors in India

Understand what a custodian in a mutual fund does, its role, functions, and importance for investor protection in India.

Understand what a custodian in a mutual fund does, its role, functions, and importance for investor protection in India.

Understand what a custodian in a mutual fund does, its role, functions, and importance for investor protection in India.

Ckredence Wealth

Ckredence Wealth

|

January 17, 2026

January 17, 2026

Mutual funds today manage a significant portion of household savings in India. As of December 2025, the Indian mutual fund industry manages over ₹80 lakh crore in assets, reflecting the scale at which investor money is pooled and deployed across markets.

At this scale, investor protection cannot rely only on fund performance or reputation. It depends on strong institutional safeguards that ensure assets are held securely, trades are settled correctly, and conflicts of interest are avoided. One such safeguard is the custodian.

Many investors assume that asset management companies directly hold the securities they manage. That assumption is incorrect. Indian mutual funds follow a clear separation between asset management, asset holding, and asset oversight. The custodian sits at the center of this separation.

Before going deeper, ask yourself:

Who actually holds the shares and bonds your mutual fund invests in?

What prevents misuse of investor assets by fund managers?

How are trades settled and verified independently?

This article explains the custodian meaning in mutual fund investing, the role of custodian in mutual fund operations, and why this structure is essential for investor protection in India.

Key Takeaways

A custodian in a mutual fund is an independent entity that holds and safeguards fund assets.

Custodians operate separately from asset management companies and fund managers.

Their role ensures segregation of duties, reducing fraud and conflict of interest.

Mutual fund custodians in India follow strict SEBI regulations.

Custodians handle safekeeping, settlement, record keeping, and compliance support.

Investors rarely interact with custodians, but their protection depends on them.

Strong custody systems increase trust and transparency in mutual fund investing.

What Is a Custodian in a Mutual Fund?

A custodian in a mutual fund is a financial institution appointed to hold and protect the securities owned by a mutual fund. These securities may include equity shares, bonds, government securities, and other market instruments. The custodian does not manage investments or make portfolio decisions.

The custodian’s primary responsibility is asset safekeeping. Securities are held in segregated accounts, typically in electronic or dematerialized form. This ensures that the assets of one mutual fund scheme remain distinct from others and from the custodian’s own assets.

In simple terms, the fund manager decides what to buy or sell, while the custodian ensures that what is bought or sold is properly held, recorded, and settled.

This separation is intentional. It reduces operational risk and protects investor interests across market cycles.

You can also explore how mutual funds fit into broader investment choices here:

https://ckredencewealth.com/mutual-funds

Custodian Meaning in Mutual Fund Structure

To understand the custodian meaning in mutual fund investing, it helps to view the mutual fund ecosystem as a system of checks and balances.

A mutual fund structure typically includes:

Trustees, who oversee the fund in investors’ interests

The asset management company, which manages investments

The registrar and transfer agent, which handles investor records

The custodian, which holds the assets

The custodian acts as an independent gatekeeper. It verifies that transactions initiated by the fund manager are valid and executed correctly. It also confirms that securities received after a purchase are properly credited and that securities sold are delivered as required.

This structure ensures that no single entity has unchecked control over investor money.

Role of Custodian in Mutual Fund Operations

The role of custodian in mutual fund operations goes beyond simply holding securities. It covers several operational and regulatory responsibilities that support the fund’s integrity.

Asset Safekeeping

The custodian holds all securities belonging to the mutual fund in secure and segregated accounts. These assets are typically held in demat form with depositories. This setup prevents unauthorized use or diversion of assets.

Record Keeping and Reporting

Custodians maintain detailed records of all securities, transactions, and corporate actions. These records must align with the fund’s books and are subject to audits and regulatory reviews.

Trade Settlement

When a fund buys or sells securities, the custodian manages the settlement process. This includes ensuring that payments are made and securities are delivered correctly within prescribed timelines.

Regulatory Support

Custodians help mutual funds meet regulatory requirements by maintaining compliant systems and reporting standards. They support transparency and accurate disclosures.

Each of these responsibilities plays a role in protecting investors and maintaining market stability.

Mutual Fund Custodians Perform Which of the Following Functions?

When evaluating custody services, investors often ask which tasks are handled by custodians. Mutual fund custodians perform which of the following functions is a common examination and interview question in finance.

The key functions include:

Holding and safeguarding securities

Settling trades executed by fund managers

Maintaining transaction and holding records

Handling corporate actions like dividends and interest

Supporting audits and regulatory inspections

Ensuring segregation between fund assets and AMC assets

These functions ensure that asset ownership is clear, verifiable, and protected at all times.

Why Custodians Are Important for Investor Protection

Custodians play a direct role in investor protection, even though investors rarely interact with them.

Segregation of Duties

One of the most important principles in mutual fund governance is segregation of duties. Fund managers manage money. Custodians hold assets. This separation prevents conflicts of interest and misuse.

Risk Reduction

By independently verifying trades and holdings, custodians reduce operational and settlement risks. Errors, fraud, or unauthorized transactions are easier to detect.

Transparency and Trust

Custodial records act as an independent source of truth. This transparency builds investor confidence, especially during periods of market stress or volatility.

Without custodians, investors would rely entirely on fund managers’ internal systems, which increases risk.

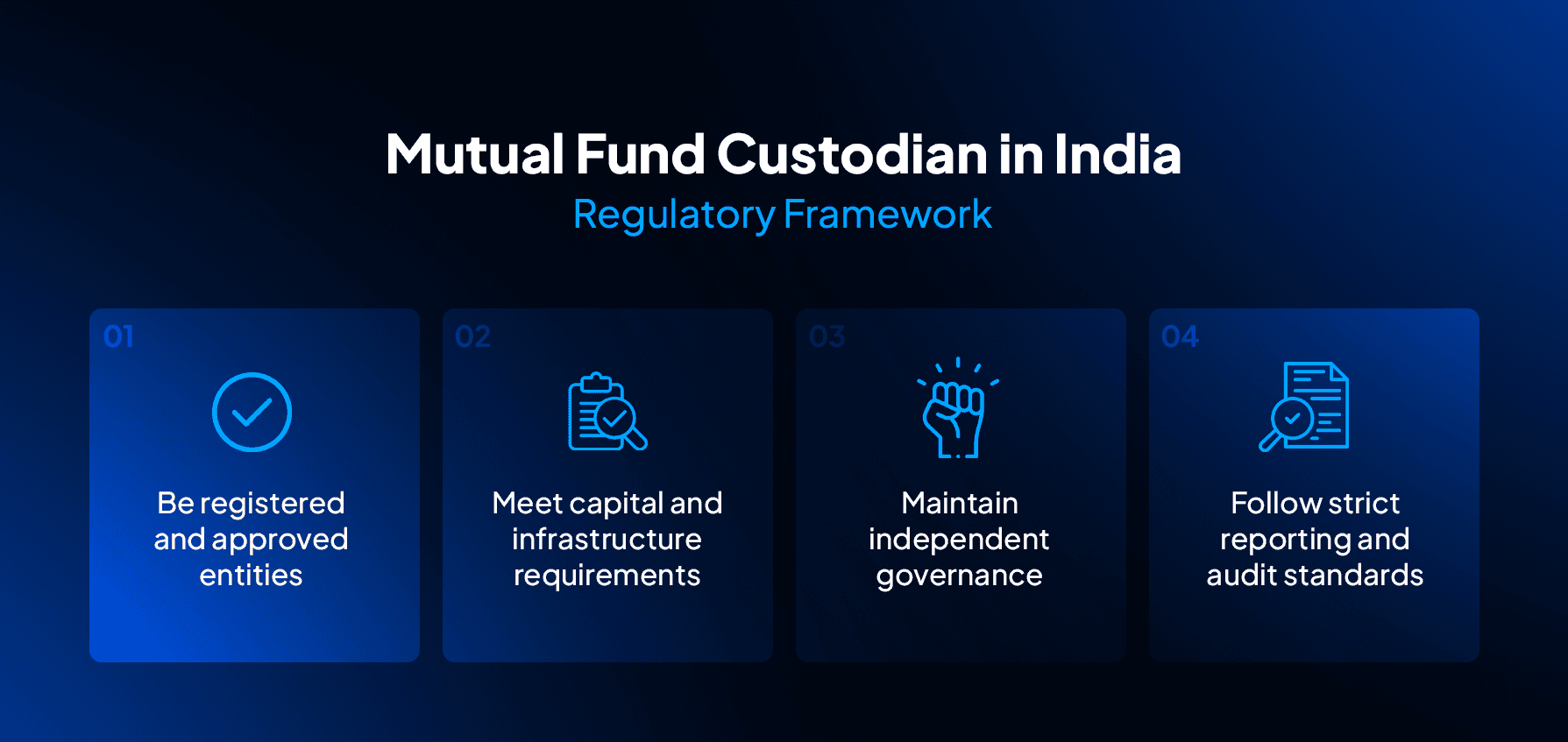

Mutual Fund Custodian in India: Regulatory Framework

The mutual fund custodian in India operates under a clearly defined regulatory framework. The Securities and Exchange Board of India requires every mutual fund to appoint an independent custodian.

Custodians must:

Be registered and approved entities

Meet capital and infrastructure requirements

Maintain independent governance

Follow strict reporting and audit standards

This framework ensures that custodians remain neutral and focused on asset protection rather than profit-driven fund management.

The Custodian of a Mutual Fund vs Other Entities

Investors often confuse the roles of different entities within a mutual fund. Understanding how the custodian of a mutual fund differs from others helps clarify accountability.

The fund manager decides investment strategy and trades.

The AMC executes and manages the portfolio.

The custodian holds and safeguards the assets.

The registrar manages investor data and transactions.

Each role is distinct. This division reduces dependency on any single party and strengthens investor safeguards.

To understand how professional portfolio services differ from pooled vehicles like mutual funds, you can also refer to:

https://ckredencewealth.com/our-resources/portfolio-management-services-vs-mutual-funds

What Custodians Do Not Do

It is equally important to understand what custodians do not do.

Custodians do not:

Decide which securities to buy or sell

Manage portfolio performance

Interact with investors on investments

Influence fund strategy or asset allocation

Their role is operational, not advisory or strategic.

How Custodians Support Market Stability

Custodians contribute to broader market stability by ensuring smooth settlement processes and accurate asset ownership records. Efficient custody systems reduce counterparty risk and settlement failures.

During volatile markets, custodians ensure that asset records remain accurate even when trading volumes surge. This reliability supports confidence across the financial system.

Common Misconceptions About Mutual Fund Custodians

Many investors believe that mutual fund assets are pooled under the AMC’s control. Others assume custodians only store documents. Both assumptions are incorrect.

Custodians actively manage operational workflows that keep the investment system functioning. Their work is continuous, technical, and essential.

Why This Matters to Long-Term Investors

For long-term investors, especially those building wealth through systematic investments, custodians provide structural safety. Returns matter, but protection matters first.

Strong custody systems ensure that investment growth is supported by governance, transparency, and legal safeguards.

Why Should You Choose a Wealth Manager Who Explains This Clearly?

Investors benefit when wealth managers explain not just returns, but structures. Understanding custody builds confidence and realistic expectations.

A clear explanation of how assets are protected reflects a focus on investor education and long-term trust.

How Ckredence Wealth Looks at Custody and Investor Protection

Understanding the role of a custodian in a mutual fund is not just academic. It reflects how seriously an investment platform treats structure, transparency, and investor protection.

At Ckredence Wealth, mutual fund selection is not limited to performance metrics or short-term rankings. Equal weight is given to how a fund is structured, including the independence of its custodian, settlement practices, and regulatory discipline. This approach ensures that investors are not exposed to avoidable operational or governance risks.

When clients invest through Ckredence Wealth, they benefit from:

Careful evaluation of mutual fund structures, not just returns

Preference for funds with strong governance and clear segregation of roles

Alignment with SEBI-regulated frameworks that protect investor assets

This perspective becomes especially important for investors comparing mutual funds with other investment options or planning long-term allocations.

For a broader view on how mutual funds fit within overall wealth planning, readers may also explore:

https://ckredencewealth.com/our-resources/what-is-wealth-management

Ckredence Wealth’s role is not to replace the safeguards built into mutual funds, but to help investors understand and choose within those safeguards wisely. When investors know how their assets are protected, decision-making becomes calmer and more informed.

Conclusion

A custodian in a mutual fund plays a foundational role in protecting investor assets. By holding securities independently, settling trades accurately, and maintaining transparent records, custodians uphold the integrity of the mutual fund system.

For Indian investors, understanding the role of custodians clarifies how regulations, governance, and operational checks work together. Mutual fund returns depend on markets, but investor protection depends on structure. Custodians are a core part of that structure.

FAQs

What is a custodian in a mutual fund?

A custodian in a mutual fund is an independent entity that holds and safeguards fund assets securely.

What is the role of custodian in mutual fund investing?

The role of custodian in mutual fund investing is to hold assets, settle trades, and maintain records.

Are mutual fund custodians mandatory in India?

Yes, mutual fund custodians in India are mandatory under SEBI regulations.

Do investors interact directly with mutual fund custodians?

Investors do not interact directly with custodians, but custodians protect their invested assets.

Mutual funds today manage a significant portion of household savings in India. As of December 2025, the Indian mutual fund industry manages over ₹80 lakh crore in assets, reflecting the scale at which investor money is pooled and deployed across markets.

At this scale, investor protection cannot rely only on fund performance or reputation. It depends on strong institutional safeguards that ensure assets are held securely, trades are settled correctly, and conflicts of interest are avoided. One such safeguard is the custodian.

Many investors assume that asset management companies directly hold the securities they manage. That assumption is incorrect. Indian mutual funds follow a clear separation between asset management, asset holding, and asset oversight. The custodian sits at the center of this separation.

Before going deeper, ask yourself:

Who actually holds the shares and bonds your mutual fund invests in?

What prevents misuse of investor assets by fund managers?

How are trades settled and verified independently?

This article explains the custodian meaning in mutual fund investing, the role of custodian in mutual fund operations, and why this structure is essential for investor protection in India.

Key Takeaways

A custodian in a mutual fund is an independent entity that holds and safeguards fund assets.

Custodians operate separately from asset management companies and fund managers.

Their role ensures segregation of duties, reducing fraud and conflict of interest.

Mutual fund custodians in India follow strict SEBI regulations.

Custodians handle safekeeping, settlement, record keeping, and compliance support.

Investors rarely interact with custodians, but their protection depends on them.

Strong custody systems increase trust and transparency in mutual fund investing.

What Is a Custodian in a Mutual Fund?

A custodian in a mutual fund is a financial institution appointed to hold and protect the securities owned by a mutual fund. These securities may include equity shares, bonds, government securities, and other market instruments. The custodian does not manage investments or make portfolio decisions.

The custodian’s primary responsibility is asset safekeeping. Securities are held in segregated accounts, typically in electronic or dematerialized form. This ensures that the assets of one mutual fund scheme remain distinct from others and from the custodian’s own assets.

In simple terms, the fund manager decides what to buy or sell, while the custodian ensures that what is bought or sold is properly held, recorded, and settled.

This separation is intentional. It reduces operational risk and protects investor interests across market cycles.

You can also explore how mutual funds fit into broader investment choices here:

https://ckredencewealth.com/mutual-funds

Custodian Meaning in Mutual Fund Structure

To understand the custodian meaning in mutual fund investing, it helps to view the mutual fund ecosystem as a system of checks and balances.

A mutual fund structure typically includes:

Trustees, who oversee the fund in investors’ interests

The asset management company, which manages investments

The registrar and transfer agent, which handles investor records

The custodian, which holds the assets

The custodian acts as an independent gatekeeper. It verifies that transactions initiated by the fund manager are valid and executed correctly. It also confirms that securities received after a purchase are properly credited and that securities sold are delivered as required.

This structure ensures that no single entity has unchecked control over investor money.

Role of Custodian in Mutual Fund Operations

The role of custodian in mutual fund operations goes beyond simply holding securities. It covers several operational and regulatory responsibilities that support the fund’s integrity.

Asset Safekeeping

The custodian holds all securities belonging to the mutual fund in secure and segregated accounts. These assets are typically held in demat form with depositories. This setup prevents unauthorized use or diversion of assets.

Record Keeping and Reporting

Custodians maintain detailed records of all securities, transactions, and corporate actions. These records must align with the fund’s books and are subject to audits and regulatory reviews.

Trade Settlement

When a fund buys or sells securities, the custodian manages the settlement process. This includes ensuring that payments are made and securities are delivered correctly within prescribed timelines.

Regulatory Support

Custodians help mutual funds meet regulatory requirements by maintaining compliant systems and reporting standards. They support transparency and accurate disclosures.

Each of these responsibilities plays a role in protecting investors and maintaining market stability.

Mutual Fund Custodians Perform Which of the Following Functions?

When evaluating custody services, investors often ask which tasks are handled by custodians. Mutual fund custodians perform which of the following functions is a common examination and interview question in finance.

The key functions include:

Holding and safeguarding securities

Settling trades executed by fund managers

Maintaining transaction and holding records

Handling corporate actions like dividends and interest

Supporting audits and regulatory inspections

Ensuring segregation between fund assets and AMC assets

These functions ensure that asset ownership is clear, verifiable, and protected at all times.

Why Custodians Are Important for Investor Protection

Custodians play a direct role in investor protection, even though investors rarely interact with them.

Segregation of Duties

One of the most important principles in mutual fund governance is segregation of duties. Fund managers manage money. Custodians hold assets. This separation prevents conflicts of interest and misuse.

Risk Reduction

By independently verifying trades and holdings, custodians reduce operational and settlement risks. Errors, fraud, or unauthorized transactions are easier to detect.

Transparency and Trust

Custodial records act as an independent source of truth. This transparency builds investor confidence, especially during periods of market stress or volatility.

Without custodians, investors would rely entirely on fund managers’ internal systems, which increases risk.

Mutual Fund Custodian in India: Regulatory Framework

The mutual fund custodian in India operates under a clearly defined regulatory framework. The Securities and Exchange Board of India requires every mutual fund to appoint an independent custodian.

Custodians must:

Be registered and approved entities

Meet capital and infrastructure requirements

Maintain independent governance

Follow strict reporting and audit standards

This framework ensures that custodians remain neutral and focused on asset protection rather than profit-driven fund management.

The Custodian of a Mutual Fund vs Other Entities

Investors often confuse the roles of different entities within a mutual fund. Understanding how the custodian of a mutual fund differs from others helps clarify accountability.

The fund manager decides investment strategy and trades.

The AMC executes and manages the portfolio.

The custodian holds and safeguards the assets.

The registrar manages investor data and transactions.

Each role is distinct. This division reduces dependency on any single party and strengthens investor safeguards.

To understand how professional portfolio services differ from pooled vehicles like mutual funds, you can also refer to:

https://ckredencewealth.com/our-resources/portfolio-management-services-vs-mutual-funds

What Custodians Do Not Do

It is equally important to understand what custodians do not do.

Custodians do not:

Decide which securities to buy or sell

Manage portfolio performance

Interact with investors on investments

Influence fund strategy or asset allocation

Their role is operational, not advisory or strategic.

How Custodians Support Market Stability

Custodians contribute to broader market stability by ensuring smooth settlement processes and accurate asset ownership records. Efficient custody systems reduce counterparty risk and settlement failures.

During volatile markets, custodians ensure that asset records remain accurate even when trading volumes surge. This reliability supports confidence across the financial system.

Common Misconceptions About Mutual Fund Custodians

Many investors believe that mutual fund assets are pooled under the AMC’s control. Others assume custodians only store documents. Both assumptions are incorrect.

Custodians actively manage operational workflows that keep the investment system functioning. Their work is continuous, technical, and essential.

Why This Matters to Long-Term Investors

For long-term investors, especially those building wealth through systematic investments, custodians provide structural safety. Returns matter, but protection matters first.

Strong custody systems ensure that investment growth is supported by governance, transparency, and legal safeguards.

Why Should You Choose a Wealth Manager Who Explains This Clearly?

Investors benefit when wealth managers explain not just returns, but structures. Understanding custody builds confidence and realistic expectations.

A clear explanation of how assets are protected reflects a focus on investor education and long-term trust.

How Ckredence Wealth Looks at Custody and Investor Protection

Understanding the role of a custodian in a mutual fund is not just academic. It reflects how seriously an investment platform treats structure, transparency, and investor protection.

At Ckredence Wealth, mutual fund selection is not limited to performance metrics or short-term rankings. Equal weight is given to how a fund is structured, including the independence of its custodian, settlement practices, and regulatory discipline. This approach ensures that investors are not exposed to avoidable operational or governance risks.

When clients invest through Ckredence Wealth, they benefit from:

Careful evaluation of mutual fund structures, not just returns

Preference for funds with strong governance and clear segregation of roles

Alignment with SEBI-regulated frameworks that protect investor assets

This perspective becomes especially important for investors comparing mutual funds with other investment options or planning long-term allocations.

For a broader view on how mutual funds fit within overall wealth planning, readers may also explore:

https://ckredencewealth.com/our-resources/what-is-wealth-management

Ckredence Wealth’s role is not to replace the safeguards built into mutual funds, but to help investors understand and choose within those safeguards wisely. When investors know how their assets are protected, decision-making becomes calmer and more informed.

Conclusion

A custodian in a mutual fund plays a foundational role in protecting investor assets. By holding securities independently, settling trades accurately, and maintaining transparent records, custodians uphold the integrity of the mutual fund system.

For Indian investors, understanding the role of custodians clarifies how regulations, governance, and operational checks work together. Mutual fund returns depend on markets, but investor protection depends on structure. Custodians are a core part of that structure.

FAQs

What is a custodian in a mutual fund?

A custodian in a mutual fund is an independent entity that holds and safeguards fund assets securely.

What is the role of custodian in mutual fund investing?

The role of custodian in mutual fund investing is to hold assets, settle trades, and maintain records.

Are mutual fund custodians mandatory in India?

Yes, mutual fund custodians in India are mandatory under SEBI regulations.

Do investors interact directly with mutual fund custodians?

Investors do not interact directly with custodians, but custodians protect their invested assets.