8 Min Read

8 Min Read

AIF Taxation in India: Rules, Rates & Investor Guide 2026

AIF Taxation in India: Rules, Rates & Investor Guide 2026

AIF Taxation in India: Rules, Rates & Investor Guide 2026

Complete guide on AIF taxation in India. Learn Category I, II, III tax rules, rates, TDS, LTCG/STCG treatment, and investor compliance

Complete guide on AIF taxation in India. Learn Category I, II, III tax rules, rates, TDS, LTCG/STCG treatment, and investor compliance

Complete guide on AIF taxation in India. Learn Category I, II, III tax rules, rates, TDS, LTCG/STCG treatment, and investor compliance

Ckredence Wealth

Ckredence Wealth

|

January 30, 2026

January 30, 2026

Alternative Investment Funds represent a ₹15.05 lakh crore opportunity in India as of September 2025, according to SEBI's official data. The AIF industry has witnessed remarkable growth, with total commitments jumping from ₹12.43 lakh crore in September 2024 to ₹15.05 lakh crore in September 2025, representing a year-on-year growth of over 21%. High-net-worth individuals are moving capital into AIFs for better returns and portfolio flexibility. Yet taxation decides your actual gains.

The Income Tax Act treats each AIF category differently. Category I and II investors face pass-through taxation where income lands in their hands. Category III funds pay tax at fund level before distributing returns. This difference changes your post-tax returns by 15-20% annually.

Budget 2024 brought major changes to capital gains. Long-term gains now attract 12.5% tax without indexation. Short-term equity gains jumped to 20% from 15%. These updates affect how AIF income flows to your bank account.

Are you losing 30-40% of AIF returns to incorrect tax planning?

Do you know which AIF category saves more tax based on your income slab?

Can you claim the right deductions and avoid double taxation on distributions?

This guide breaks down AIF taxation rules for 2026. We cover Category-wise treatment, capital gains, TDS implications, and compliance steps. You'll learn how to choose tax-efficient AIFs and maximize your wealth growth through smart structuring.

Key Takeaways

Category I and II AIFs follow pass-through taxation, meaning income is taxed directly in investor hands at applicable rates while Category III funds pay tax at fund level before distribution.

Long-term capital gains from AIFs attract 12.5% tax post-July 2024 changes, with no indexation benefit for new investments under revised Budget provisions.

TDS on AIF distributions is 10% for resident investors and varies for NRIs based on income type and applicable DTAA provisions.

Business income generated by Category I and II AIFs gets taxed at fund level, not in investor hands, making income classification important for tax planning.

Investors must report pass-through income in ITR with proper documentation including Form 64C from fund managers to claim TDS credits and avoid compliance penalties.

NRI investors can reduce tax burden through DTAA benefits by submitting valid Tax Residency Certificate and Form 10F to fund managers before distributions.

Choosing the right AIF category based on your tax slab and investment goals can improve post-tax returns by 15-20% annually for HNI portfolios.

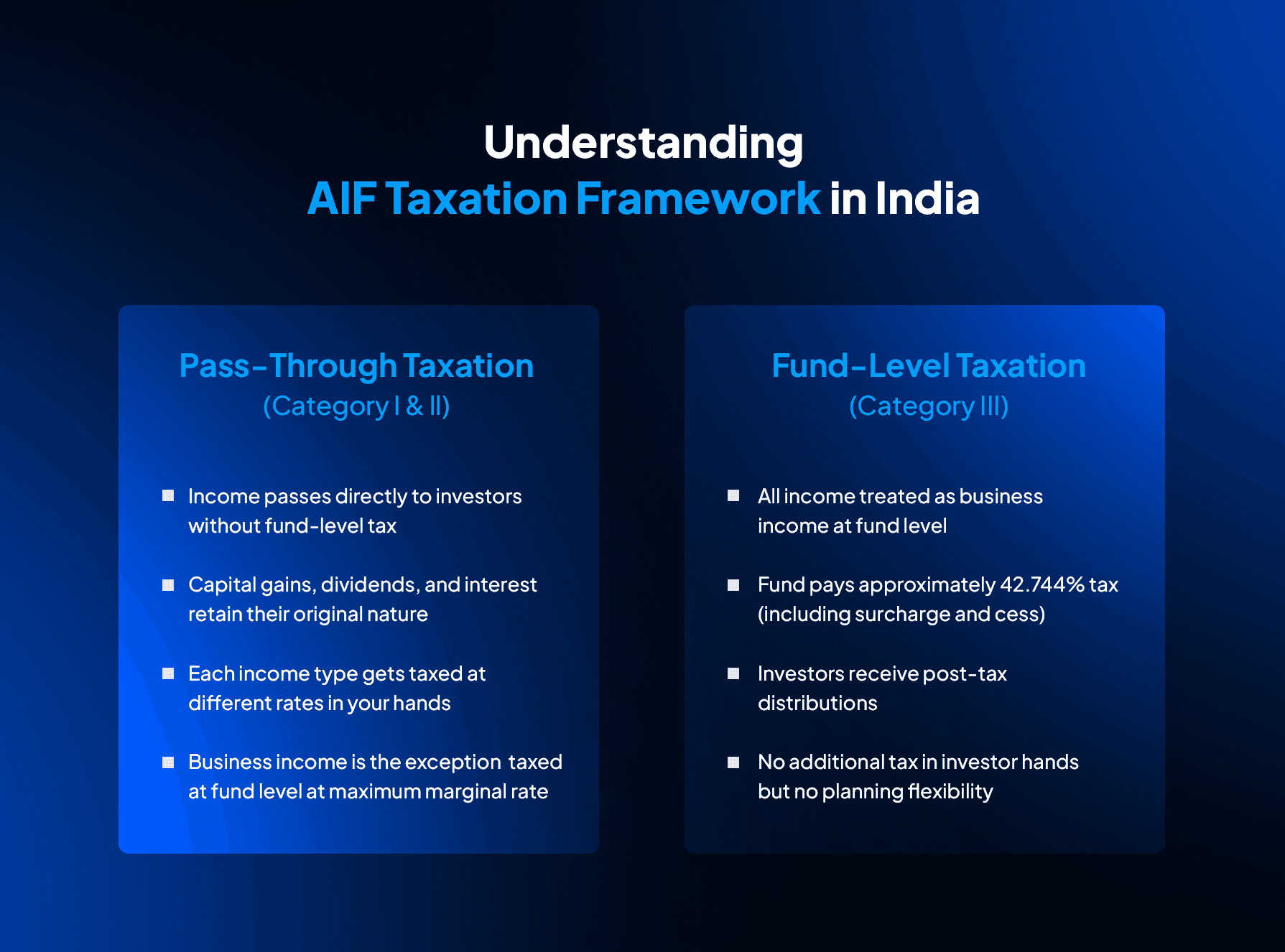

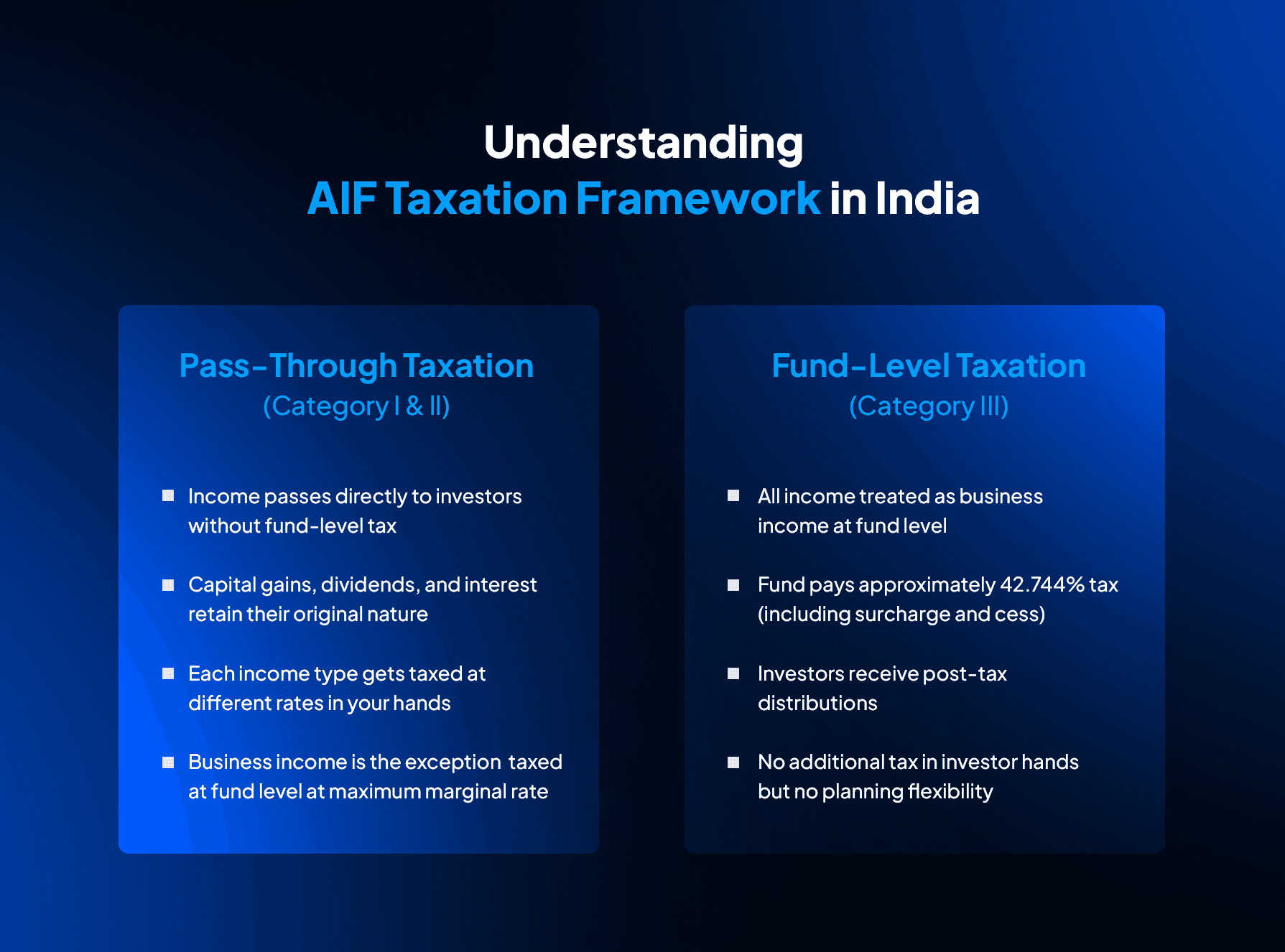

Understanding AIF Taxation Framework in India

AIFs operate under SEBI regulations but tax treatment depends on fund category. The Income Tax Act divides taxation into two models: pass-through and fund-level.

Pass-Through Taxation (Category I & II)

Category I and II AIFs get special treatment under Section 115UB:

Income passes directly to investors without fund-level tax

Capital gains, dividends, and interest retain their original nature

Each income type gets taxed at different rates in your hands

Business income is the exception - taxed at fund level at maximum marginal rate

Fund-Level Taxation (Category III)

Category III AIFs operate differently:

All income treated as business income at fund level

Fund pays approximately 42.744% tax (30% base rate + 37% surcharge + 4% cess on trusts)

Investors receive post-tax distributions

No additional tax in investor hands but no planning flexibility

Critical Documentation

Forms You'll Receive:

Form 64C - Shows income distributed and TDS deducted (for investors)

Form 64D - Filed by AIF with tax authorities (by June 15 annually)

Missing documentation leads to notices and potential penalties. Keep all forms for ITR filing and TDS credit claims.

Recent Regulatory Updates (2024-2025)

SEBI has introduced several changes to strengthen the AIF ecosystem:

1. Dematerialization Mandate (Effective October 1, 2024):

All AIF investments made after October 1, 2024 must be held in dematerialized form. This:

Streamlines ownership tracking

Reduces operational errors

Enhances regulatory oversight

Facilitates easier transfers

Exception: AIF schemes with tenure ending on or before January 31, 2025, or those already in extended tenure, are exempted.

2. Mandatory Custodian Requirement:

All new AIF schemes must appoint a custodian before making their first investment, regardless of fund corpus size. Previously, this applied only to:

Category I & II AIFs with corpus >₹500 crore

All Category III AIFs

This change improves custodial oversight and investor protection.

AIF Investment Landscape in India

According to SEBI data as of September 2025, AIFs have deployed capital across diverse sectors:

Top 10 Sectors by AIF Investments:

Real Estate: ₹73,356 crore (17% of total investments)

Financial Services: ₹51,388 crore

IT/ITes: ₹35,997 crore

NBFCs: ₹30,748 crore

Banks: ₹25,287 crore

Pharmaceuticals: ₹22,581 crore

Insurance: ₹15,062 crore

Health Care Providers & Services: ₹14,228 crore

Automobiles: ₹12,913 crore

Others: ₹3,30,379 crore

This sectoral diversification demonstrates AIFs' role in funding critical sectors of the Indian economy, from infrastructure to innovation.

Category I and II AIF Taxation Rules

Category I and II AIFs share the same tax structure using pass-through model. These include venture capital funds, private equity funds, real estate funds, and debt funds.

Capital Gains Taxation (Post-Budget 2024)

Long-Term Capital Gains:

Assets held over 12 months attract 12.5% tax

No indexation benefit from July 23, 2024

Listed equity gets ₹1.25 lakh exemption per year

Unlisted equity and other assets have no exemption

Short-Term Capital Gains:

Listed equity with STT: 20% tax under Section 111A

Other short-term gains: Your applicable slab rate

Transitional Relief (For Properties Purchased Before July 23, 2024):

For immovable property purchased before July 23, 2024 and sold by resident individuals and HUFs, you can choose the lower tax between:

New rule: 12.5% without indexation

Old rule: 20% with indexation

Important: Properties purchased after July 23, 2024 are subject to 12.5% LTCG without indexation only.

Source: Budget 2024 Capital Gains Changes

Other Income Types

Dividends and Interest:

Added to your total income

Taxed at your slab rate (up to 30% plus surcharge and cess)

Business Income:

Taxed at fund level at maximum marginal rate (~42.744% for trusts)

Only net amounts distributed to investors

TDS Rules Under Section 194LBB

For Resident Investors:

AIF deducts 10% TDS on distributions under Section 194LBB

Claim credit when filing ITR

Pay advance tax if total liability exceeds ₹10,000

For Non-Resident Investors:

TDS at rates prescribed in Income Tax Act

Lower rates possible through DTAA

Submit Tax Residency Certificate and Form 10F for reduced TDS

Must file ITR in India if income exceeds basic exemption

Category III AIF Taxation Explained

Category III AIFs include hedge funds and complex trading strategies. Tax treatment differs completely from Category I and II.

How Fund-Level Taxation Works

Key Features:

All income classified as business income

No preferential capital gains treatment

Fund pays ~42.744% effective rate (30% base + 37% surcharge + 4% cess)

Investors receive only post-tax distributions

Tax Comparison Example:

Category III AIF earning ₹100 profit:

Fund pays ₹42.74 tax

Investors receive ₹57.26

Effective burden: 42.74%

Category II AIF with same ₹100 (investor in 30% slab):

Fund pays zero tax

Investor pays ₹30 tax

Investor receives ₹70

Effective burden: 30%

The 12.74% difference matters significantly for large investments.

Investor Compliance

What You Need to Do:

Report distributions in ITR under "income from other sources"

Claim exemption by noting tax paid at fund level

Maintain investment documents and annual statements

Simple reporting - no complex income classification needed

Category III makes sense when investment strategy overcomes higher tax drag. The fund manager handles all tax complexity.

Tax Compliance and Filing Requirements for AIF Investors

Proper compliance protects you from penalties and ensures smooth refunds. AIF investments create specific reporting obligations.

Essential Documents to Maintain

Core Records:

Subscription agreement and capital call notices

Form 64C (annual income and TDS statement from AIF)

Distribution statements and bank confirmations

Investment certificates and unit allotments

Quarterly portfolio statements

For Category I & II Additional:

Original investment certificates for capital gains calculation

Valuation reports for unlisted securities

Fund expense notices

ITR Filing Steps for Residents

Choosing ITR Form:

ITR-2: For capital gains and investment income

ITR-3: If you have business income

Reporting Pass-Through Income (Category I & II):

Capital gains → Schedule CG (separate short-term and long-term)

Interest income → Schedule OS under "interest on securities"

Dividends → Schedule OS under dividend section

Business income → Report as per Form 64C

TDS Credit Claims:

Match Form 64C with Form 26AS

Verify deductor PAN accuracy

Enter all TDS in taxes paid section

Advance Tax Payment:

If tax liability after TDS exceeds ₹10,000, pay in four instalments: June 15, September 15, December 15, March 15

NRI Investor Compliance

Filing Requirements:

File ITR if total income exceeds ₹2.5 lakh

Use ITR-2 or ITR-3 based on income sources

DTAA Benefit Process:

● Obtain Tax Residency Certificate from resident country

● Submit TRC with Form 10F to AIF before distribution

● Claim refund in ITR if standard TDS was deducted

Repatriation Steps:

Step 1: Use NRE or NRO account per fund structure

Step 2: Submit Form 15CA and 15CB for amounts above ₹5 lakh

Step 3: Obtain CA certification on tax payment

Common Filing Mistakes to Avoid

Never omit AIF income assuming distributions are tax-free

Don't mix short-term and long-term capital gains classifications

Avoid claiming indexation on post-July 23, 2024 investments

Double-check TDS credit entries against Form 26AS

Report even Category III distributions for proper disclosure

Tax Planning Strategies for AIF Investors

Smart structuring reduces tax liability without changing investment strategy. High-net-worth individuals can save 15-20% through proper planning.

Choosing the Right Category

For Lower Tax Brackets (20% or below):

● Category I and II work better with pass-through taxation

● You pay at your actual rate instead of fund's 42.744%

● Example: ₹1 crore investment at 15% return

○ Category III delivers ₹8.58 lakh post-tax

○ Category II delivers ₹12 lakh (20% bracket)

○ Difference: ₹3.42 lakh annually

For High-Income Earners (30% plus surcharge):

Your effective rate reaches ~42.744% (same as Category III)

Category III offers simpler compliance

No advance tax calculations or loss tracking needed

Timing Strategies

Exit Planning:

Time exits during low-income years (like post-retirement)

Use capital loss set-offs from other investments

Plan equity sales around AIF distribution cycles

Loss Set-Off Rules:

Long-term losses offset only long-term gains

Short-term losses offset both types

Carry forward unused losses for 8 years

NRI Tax Optimization

DTAA Benefits:

Check country-specific treaty provisions

Submit TRC and Form 10F early for lower TDS

Time residency changes around distribution dates

Family Structuring

Income Splitting:

Gift capital to family members in lower brackets before investing

Use proper gift deeds and separate bank accounts

HUF investments create additional tax layer for planning

Portfolio Mix Strategy

Efficient Allocation:

Use Category II for long-term equity (12.5% LTCG)

Use Category III for complex trading strategies

Balance with direct equity and debt mutual funds

Annual Review:

Schedule February review with tax advisor

Calculate projected income including AIF distributions

Adjust advance tax payments accordingly

Obtain Form 64C by May for timely ITR filing

Why Should You Choose Ckredence Wealth for AIF Investments?

High-net-worth individuals need partners who understand both investment strategy and tax efficiency. Your AIF selection should consider post-tax returns, not just gross performance.

Ckredence Wealth brings 37 years of experience managing ₹805+ crores for 376+ active clients. Our SEBI-registered expertise helps you choose AIF categories matching your tax profile.

Our Tax-Efficient Approach:

Pre-investment analysis comparing post-tax returns across categories

Annual planning reviews considering distributions and portfolio

Coordination with your CA for optimal ITR filing

DTAA guidance for NRI investors

Key Capabilities:

Curated AIF opportunities across all three categories

Risk-adjusted construction considering tax implications

Transparent reporting for easy compliance

Dedicated support across Gujarat and Maharashtra

Smart investors know net returns matter most. We help you build wealth through strategies matching your risk profile and income situation.

Ready to optimize your AIF investments? Schedule a Consultation with our wealth advisors today.

Conclusion

AIF taxation determines your actual investment returns. Category I and II offer pass-through flexibility where income reaches your hands at applicable rates. Category III provides simplicity with fund-level taxation but removes individual tax planning control. Budget 2024 changes brought 12.5% LTCG and 20% STCG rates that affect your net gains.

Choose AIF categories matching your tax profile. Review distributions annually with your advisor. Maintain complete documentation for compliance. Time your entries and exits considering your income pattern. Your wealth grows faster when tax efficiency meets investment strategy.

FAQs

How does AIF taxation differ from mutual fund taxation in India?

AIFs follow pass-through or fund-level taxation based on category. Mutual funds always pass through to investors. AIF Category III pays tax at fund level unlike any mutual fund structure. This creates different post-tax returns for similar gross performance.

What is the minimum investment required for tax-efficient AIF planning?

The minimum investment for most AIFs is ₹1 crore as per SEBI regulations, with exceptions of ₹25 lakh for employees/directors of fund managers or sponsors. Tax efficiency improves with higher amounts due to fixed compliance costs. Investors should evaluate post-tax returns considering their income slab and investment size before committing capital.

Can NRI investors claim DTAA benefits on AIF distributions in India?

Yes, NRI investors can claim DTAA benefits on AIF income. You must submit Tax Residency Certificate and Form 10F to the fund manager before distribution. Treaty provisions override Indian tax rates when beneficial. Proper documentation ensures lower TDS deduction at source.

Are AIF investments eligible for Section 54 capital gains exemption benefits?

Some real estate AIF capital gains may qualify for Section 54 exemption if you invest proceeds in residential property. Category I and II pass-through gains retain their nature making exemptions possible. Check specific fund structure and income classification before claiming benefit in ITR.

Alternative Investment Funds represent a ₹15.05 lakh crore opportunity in India as of September 2025, according to SEBI's official data. The AIF industry has witnessed remarkable growth, with total commitments jumping from ₹12.43 lakh crore in September 2024 to ₹15.05 lakh crore in September 2025, representing a year-on-year growth of over 21%. High-net-worth individuals are moving capital into AIFs for better returns and portfolio flexibility. Yet taxation decides your actual gains.

The Income Tax Act treats each AIF category differently. Category I and II investors face pass-through taxation where income lands in their hands. Category III funds pay tax at fund level before distributing returns. This difference changes your post-tax returns by 15-20% annually.

Budget 2024 brought major changes to capital gains. Long-term gains now attract 12.5% tax without indexation. Short-term equity gains jumped to 20% from 15%. These updates affect how AIF income flows to your bank account.

Are you losing 30-40% of AIF returns to incorrect tax planning?

Do you know which AIF category saves more tax based on your income slab?

Can you claim the right deductions and avoid double taxation on distributions?

This guide breaks down AIF taxation rules for 2026. We cover Category-wise treatment, capital gains, TDS implications, and compliance steps. You'll learn how to choose tax-efficient AIFs and maximize your wealth growth through smart structuring.

Key Takeaways

Category I and II AIFs follow pass-through taxation, meaning income is taxed directly in investor hands at applicable rates while Category III funds pay tax at fund level before distribution.

Long-term capital gains from AIFs attract 12.5% tax post-July 2024 changes, with no indexation benefit for new investments under revised Budget provisions.

TDS on AIF distributions is 10% for resident investors and varies for NRIs based on income type and applicable DTAA provisions.

Business income generated by Category I and II AIFs gets taxed at fund level, not in investor hands, making income classification important for tax planning.

Investors must report pass-through income in ITR with proper documentation including Form 64C from fund managers to claim TDS credits and avoid compliance penalties.

NRI investors can reduce tax burden through DTAA benefits by submitting valid Tax Residency Certificate and Form 10F to fund managers before distributions.

Choosing the right AIF category based on your tax slab and investment goals can improve post-tax returns by 15-20% annually for HNI portfolios.

Understanding AIF Taxation Framework in India

AIFs operate under SEBI regulations but tax treatment depends on fund category. The Income Tax Act divides taxation into two models: pass-through and fund-level.

Pass-Through Taxation (Category I & II)

Category I and II AIFs get special treatment under Section 115UB:

Income passes directly to investors without fund-level tax

Capital gains, dividends, and interest retain their original nature

Each income type gets taxed at different rates in your hands

Business income is the exception - taxed at fund level at maximum marginal rate

Fund-Level Taxation (Category III)

Category III AIFs operate differently:

All income treated as business income at fund level

Fund pays approximately 42.744% tax (30% base rate + 37% surcharge + 4% cess on trusts)

Investors receive post-tax distributions

No additional tax in investor hands but no planning flexibility

Critical Documentation

Forms You'll Receive:

Form 64C - Shows income distributed and TDS deducted (for investors)

Form 64D - Filed by AIF with tax authorities (by June 15 annually)

Missing documentation leads to notices and potential penalties. Keep all forms for ITR filing and TDS credit claims.

Recent Regulatory Updates (2024-2025)

SEBI has introduced several changes to strengthen the AIF ecosystem:

1. Dematerialization Mandate (Effective October 1, 2024):

All AIF investments made after October 1, 2024 must be held in dematerialized form. This:

Streamlines ownership tracking

Reduces operational errors

Enhances regulatory oversight

Facilitates easier transfers

Exception: AIF schemes with tenure ending on or before January 31, 2025, or those already in extended tenure, are exempted.

2. Mandatory Custodian Requirement:

All new AIF schemes must appoint a custodian before making their first investment, regardless of fund corpus size. Previously, this applied only to:

Category I & II AIFs with corpus >₹500 crore

All Category III AIFs

This change improves custodial oversight and investor protection.

AIF Investment Landscape in India

According to SEBI data as of September 2025, AIFs have deployed capital across diverse sectors:

Top 10 Sectors by AIF Investments:

Real Estate: ₹73,356 crore (17% of total investments)

Financial Services: ₹51,388 crore

IT/ITes: ₹35,997 crore

NBFCs: ₹30,748 crore

Banks: ₹25,287 crore

Pharmaceuticals: ₹22,581 crore

Insurance: ₹15,062 crore

Health Care Providers & Services: ₹14,228 crore

Automobiles: ₹12,913 crore

Others: ₹3,30,379 crore

This sectoral diversification demonstrates AIFs' role in funding critical sectors of the Indian economy, from infrastructure to innovation.

Category I and II AIF Taxation Rules

Category I and II AIFs share the same tax structure using pass-through model. These include venture capital funds, private equity funds, real estate funds, and debt funds.

Capital Gains Taxation (Post-Budget 2024)

Long-Term Capital Gains:

Assets held over 12 months attract 12.5% tax

No indexation benefit from July 23, 2024

Listed equity gets ₹1.25 lakh exemption per year

Unlisted equity and other assets have no exemption

Short-Term Capital Gains:

Listed equity with STT: 20% tax under Section 111A

Other short-term gains: Your applicable slab rate

Transitional Relief (For Properties Purchased Before July 23, 2024):

For immovable property purchased before July 23, 2024 and sold by resident individuals and HUFs, you can choose the lower tax between:

New rule: 12.5% without indexation

Old rule: 20% with indexation

Important: Properties purchased after July 23, 2024 are subject to 12.5% LTCG without indexation only.

Source: Budget 2024 Capital Gains Changes

Other Income Types

Dividends and Interest:

Added to your total income

Taxed at your slab rate (up to 30% plus surcharge and cess)

Business Income:

Taxed at fund level at maximum marginal rate (~42.744% for trusts)

Only net amounts distributed to investors

TDS Rules Under Section 194LBB

For Resident Investors:

AIF deducts 10% TDS on distributions under Section 194LBB

Claim credit when filing ITR

Pay advance tax if total liability exceeds ₹10,000

For Non-Resident Investors:

TDS at rates prescribed in Income Tax Act

Lower rates possible through DTAA

Submit Tax Residency Certificate and Form 10F for reduced TDS

Must file ITR in India if income exceeds basic exemption

Category III AIF Taxation Explained

Category III AIFs include hedge funds and complex trading strategies. Tax treatment differs completely from Category I and II.

How Fund-Level Taxation Works

Key Features:

All income classified as business income

No preferential capital gains treatment

Fund pays ~42.744% effective rate (30% base + 37% surcharge + 4% cess)

Investors receive only post-tax distributions

Tax Comparison Example:

Category III AIF earning ₹100 profit:

Fund pays ₹42.74 tax

Investors receive ₹57.26

Effective burden: 42.74%

Category II AIF with same ₹100 (investor in 30% slab):

Fund pays zero tax

Investor pays ₹30 tax

Investor receives ₹70

Effective burden: 30%

The 12.74% difference matters significantly for large investments.

Investor Compliance

What You Need to Do:

Report distributions in ITR under "income from other sources"

Claim exemption by noting tax paid at fund level

Maintain investment documents and annual statements

Simple reporting - no complex income classification needed

Category III makes sense when investment strategy overcomes higher tax drag. The fund manager handles all tax complexity.

Tax Compliance and Filing Requirements for AIF Investors

Proper compliance protects you from penalties and ensures smooth refunds. AIF investments create specific reporting obligations.

Essential Documents to Maintain

Core Records:

Subscription agreement and capital call notices

Form 64C (annual income and TDS statement from AIF)

Distribution statements and bank confirmations

Investment certificates and unit allotments

Quarterly portfolio statements

For Category I & II Additional:

Original investment certificates for capital gains calculation

Valuation reports for unlisted securities

Fund expense notices

ITR Filing Steps for Residents

Choosing ITR Form:

ITR-2: For capital gains and investment income

ITR-3: If you have business income

Reporting Pass-Through Income (Category I & II):

Capital gains → Schedule CG (separate short-term and long-term)

Interest income → Schedule OS under "interest on securities"

Dividends → Schedule OS under dividend section

Business income → Report as per Form 64C

TDS Credit Claims:

Match Form 64C with Form 26AS

Verify deductor PAN accuracy

Enter all TDS in taxes paid section

Advance Tax Payment:

If tax liability after TDS exceeds ₹10,000, pay in four instalments: June 15, September 15, December 15, March 15

NRI Investor Compliance

Filing Requirements:

File ITR if total income exceeds ₹2.5 lakh

Use ITR-2 or ITR-3 based on income sources

DTAA Benefit Process:

● Obtain Tax Residency Certificate from resident country

● Submit TRC with Form 10F to AIF before distribution

● Claim refund in ITR if standard TDS was deducted

Repatriation Steps:

Step 1: Use NRE or NRO account per fund structure

Step 2: Submit Form 15CA and 15CB for amounts above ₹5 lakh

Step 3: Obtain CA certification on tax payment

Common Filing Mistakes to Avoid

Never omit AIF income assuming distributions are tax-free

Don't mix short-term and long-term capital gains classifications

Avoid claiming indexation on post-July 23, 2024 investments

Double-check TDS credit entries against Form 26AS

Report even Category III distributions for proper disclosure

Tax Planning Strategies for AIF Investors

Smart structuring reduces tax liability without changing investment strategy. High-net-worth individuals can save 15-20% through proper planning.

Choosing the Right Category

For Lower Tax Brackets (20% or below):

● Category I and II work better with pass-through taxation

● You pay at your actual rate instead of fund's 42.744%

● Example: ₹1 crore investment at 15% return

○ Category III delivers ₹8.58 lakh post-tax

○ Category II delivers ₹12 lakh (20% bracket)

○ Difference: ₹3.42 lakh annually

For High-Income Earners (30% plus surcharge):

Your effective rate reaches ~42.744% (same as Category III)

Category III offers simpler compliance

No advance tax calculations or loss tracking needed

Timing Strategies

Exit Planning:

Time exits during low-income years (like post-retirement)

Use capital loss set-offs from other investments

Plan equity sales around AIF distribution cycles

Loss Set-Off Rules:

Long-term losses offset only long-term gains

Short-term losses offset both types

Carry forward unused losses for 8 years

NRI Tax Optimization

DTAA Benefits:

Check country-specific treaty provisions

Submit TRC and Form 10F early for lower TDS

Time residency changes around distribution dates

Family Structuring

Income Splitting:

Gift capital to family members in lower brackets before investing

Use proper gift deeds and separate bank accounts

HUF investments create additional tax layer for planning

Portfolio Mix Strategy

Efficient Allocation:

Use Category II for long-term equity (12.5% LTCG)

Use Category III for complex trading strategies

Balance with direct equity and debt mutual funds

Annual Review:

Schedule February review with tax advisor

Calculate projected income including AIF distributions

Adjust advance tax payments accordingly

Obtain Form 64C by May for timely ITR filing

Why Should You Choose Ckredence Wealth for AIF Investments?

High-net-worth individuals need partners who understand both investment strategy and tax efficiency. Your AIF selection should consider post-tax returns, not just gross performance.

Ckredence Wealth brings 37 years of experience managing ₹805+ crores for 376+ active clients. Our SEBI-registered expertise helps you choose AIF categories matching your tax profile.

Our Tax-Efficient Approach:

Pre-investment analysis comparing post-tax returns across categories

Annual planning reviews considering distributions and portfolio

Coordination with your CA for optimal ITR filing

DTAA guidance for NRI investors

Key Capabilities:

Curated AIF opportunities across all three categories

Risk-adjusted construction considering tax implications

Transparent reporting for easy compliance

Dedicated support across Gujarat and Maharashtra

Smart investors know net returns matter most. We help you build wealth through strategies matching your risk profile and income situation.

Ready to optimize your AIF investments? Schedule a Consultation with our wealth advisors today.

Conclusion

AIF taxation determines your actual investment returns. Category I and II offer pass-through flexibility where income reaches your hands at applicable rates. Category III provides simplicity with fund-level taxation but removes individual tax planning control. Budget 2024 changes brought 12.5% LTCG and 20% STCG rates that affect your net gains.

Choose AIF categories matching your tax profile. Review distributions annually with your advisor. Maintain complete documentation for compliance. Time your entries and exits considering your income pattern. Your wealth grows faster when tax efficiency meets investment strategy.

FAQs

How does AIF taxation differ from mutual fund taxation in India?

AIFs follow pass-through or fund-level taxation based on category. Mutual funds always pass through to investors. AIF Category III pays tax at fund level unlike any mutual fund structure. This creates different post-tax returns for similar gross performance.

What is the minimum investment required for tax-efficient AIF planning?

The minimum investment for most AIFs is ₹1 crore as per SEBI regulations, with exceptions of ₹25 lakh for employees/directors of fund managers or sponsors. Tax efficiency improves with higher amounts due to fixed compliance costs. Investors should evaluate post-tax returns considering their income slab and investment size before committing capital.

Can NRI investors claim DTAA benefits on AIF distributions in India?

Yes, NRI investors can claim DTAA benefits on AIF income. You must submit Tax Residency Certificate and Form 10F to the fund manager before distribution. Treaty provisions override Indian tax rates when beneficial. Proper documentation ensures lower TDS deduction at source.

Are AIF investments eligible for Section 54 capital gains exemption benefits?

Some real estate AIF capital gains may qualify for Section 54 exemption if you invest proceeds in residential property. Category I and II pass-through gains retain their nature making exemptions possible. Check specific fund structure and income classification before claiming benefit in ITR.