6 Min Read

6 Min Read

5 Phases of Portfolio Management: A Complete Guide for HNIs in 2026

5 Phases of Portfolio Management: A Complete Guide for HNIs in 2026

5 Phases of Portfolio Management: A Complete Guide for HNIs in 2026

Security analysis, portfolio analysis, selection, revision, and evaluation—understand the 5 phases of portfolio management for better investment decisions.

Security analysis, portfolio analysis, selection, revision, and evaluation—understand the 5 phases of portfolio management for better investment decisions.

Security analysis, portfolio analysis, selection, revision, and evaluation—understand the 5 phases of portfolio management for better investment decisions.

Ckredence Wealth

Ckredence Wealth

|

December 27, 2025

December 27, 2025

SEBI’s PMS disclosures show that Indian portfolio managers currently handle over ₹3.8 lakh crore in listed equity investments alone, underlining the widespread use of disciplined, multi-phase portfolio management frameworks across the industry. Each phase builds on the previous one. The process starts with researching individual assets and ends with measuring actual performance against goals.

How do you identify which stocks or bonds deserve a place in your portfolio?

What happens when market conditions change after you've already invested?

Can you measure if your portfolio is actually meeting your financial goals?

Professional portfolio management isn't about picking random stocks. It's a step-by-step method that helps investors make better choices. Understanding these five phases helps you see how wealth managers build and maintain investment portfolios that adapt to changing markets while staying focused on your long-term financial objectives.

Key Takeaways

Portfolio management follows five connected phases that build on each other sequentially

Security analysis forms the base where individual assets are researched before any portfolio is built

Portfolio revision is ongoing and adapts your holdings when markets shift or goals change

Performance evaluation measures actual returns against benchmarks to guide future decisions

Professional managers use all five phases together to build portfolios that match investor risk profiles

Each phase requires specific skills from fundamental analysis to mathematical modeling

The process repeats continuously rather than stopping after initial portfolio construction

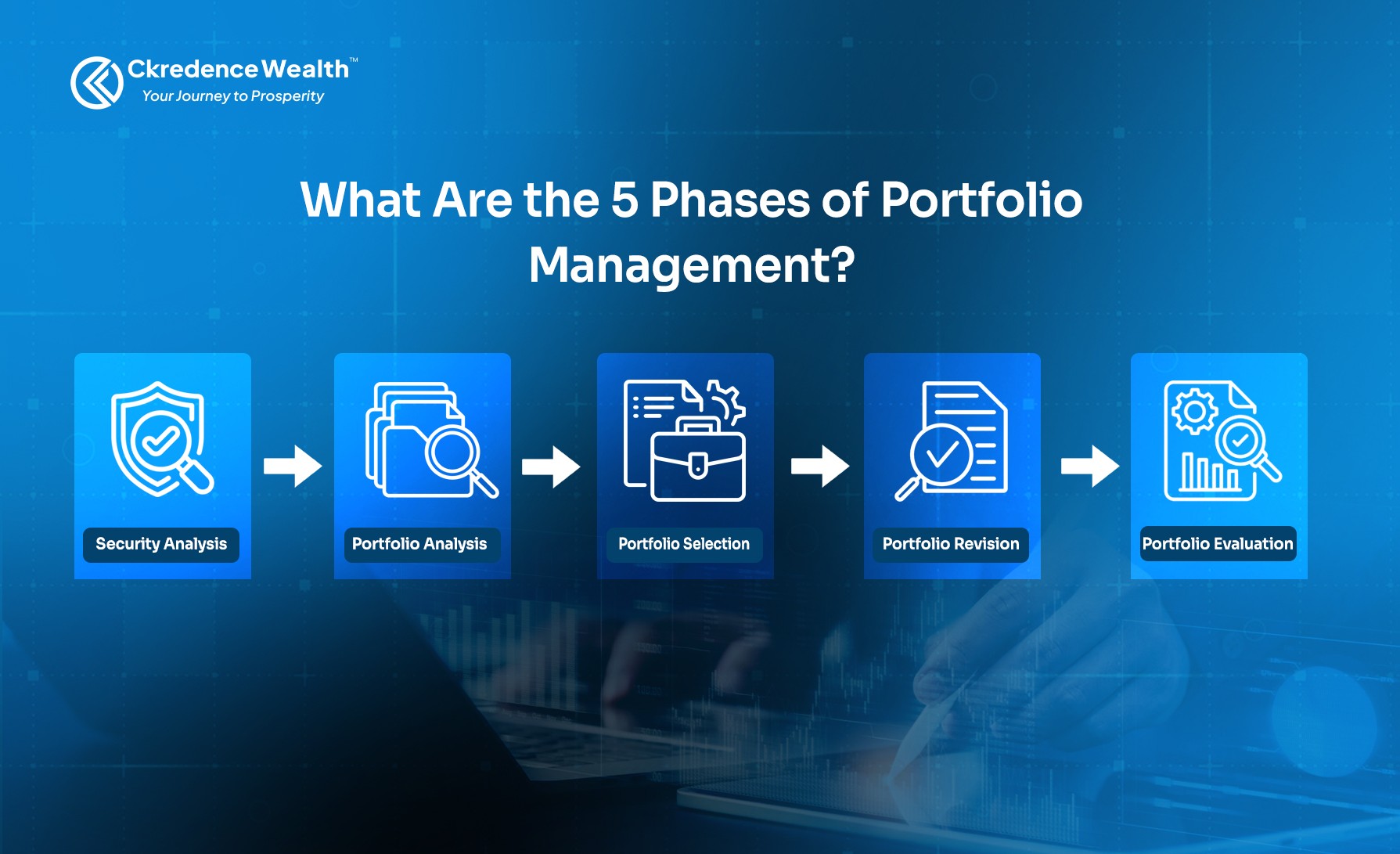

What Are the 5 Phases of Portfolio Management?

The 5 phases of portfolio management create a full cycle for investing. This process helps investors build and maintain portfolios that match their financial goals. Each phase serves a specific purpose in portfolio construction.

The phases work together as a system. You start by analyzing individual securities. Then you combine them into a portfolio. After that, you select the best mix. Next, you adjust when needed. Finally, you measure results.

Here's how the phases connect:

Security Analysis - Research individual assets to find investment opportunities

Portfolio Analysis - Combine securities and calculate risk-return profiles

Portfolio Selection - Choose the optimal portfolio from available options

Portfolio Revision - Adjust holdings based on market changes or goal shifts

Portfolio Evaluation - Measure actual performance against objectives

This cycle repeats throughout your investment journey. Markets change, goals evolve, and new opportunities appear. The five phases of portfolio management help investors respond to these changes while staying disciplined.

Professional portfolio management services use this framework daily. Each phase requires different skills and tools. Together, they form a complete method for managing wealth across market cycles.

Phase 1: Security Analysis

Security analysis examines individual investment options before they enter any portfolio. This phase looks at stocks, bonds, and other assets to determine their true value. Portfolio managers use both fundamental and technical analysis to make these assessments.

The research process includes:

Fundamental Analysis This method studies a company's financial health. Managers review balance sheets, profit margins, and cash flows. They also look at management quality and competitive advantages. The goal is to find assets trading below their actual worth.

Technical Analysis This approach examines price patterns and trading volumes. Analysts identify trends that suggest future price movements. Chart patterns and indicators help time entry and exit points for investments.

Industry and Economic Factors No company exists in isolation. Security analysis also considers sector trends and economic conditions. Interest rates, inflation, and regulatory changes all affect asset values. These factors help predict how securities might perform.

Security analysis requires deep research and expertise. At Ckredence Wealth, our team spends significant time on this phase. We analyze financial statements, meet with management teams, and track industry developments to identify quality investment opportunities for our clients.

This phase determines which assets qualify for portfolio inclusion. Strong security analysis prevents costly mistakes. It forms the foundation for all later phases in portfolio management.

Phase 2: Portfolio Analysis

Portfolio analysis takes the securities you've researched and combines them into different portfolio options. This phase uses mathematics to calculate expected returns and risks for each possible combination. The goal is to understand how different assets work together.

The key steps involved are:

Step 1: Calculate Expected Returns You estimate what each portfolio combination might earn. This uses historical data and future projections. Different weightings of assets produce different expected returns.

Step 2: Measure Portfolio Risk Risk calculation looks at return volatility. You also measure how securities move together through correlation. Lower correlation between assets reduces overall portfolio risk.

Step 3: Find the Efficient Frontier This is a graph showing portfolios that offer the best returns for each risk level. Any portfolio below this line is inefficient. It means you could get better returns for the same risk.

Portfolio analysis relies on Modern Portfolio Theory principles. Diversification reduces risk without sacrificing returns. The math shows that combining assets properly produces better outcomes than investing in single securities.

This phase reveals which portfolio combinations make sense. Some offer high returns but also high risk. Others provide stability with modest gains. The analysis shows all available options before you make final selections.

Professional managers use software to run thousands of scenarios. They test how portfolios might perform under different market conditions. This helps identify robust combinations that work across various economic environments.

Phase 3: Portfolio Selection

Portfolio selection means picking the specific portfolio that matches your investment goals. You've analyzed individual securities and calculated risk-return profiles. Now you choose which combination fits your situation best.

This decision depends on three main factors:

1. Risk Tolerance Assessment

Your comfort with market volatility shapes portfolio choice. Conservative investors prefer stable assets like bonds. Aggressive investors accept higher volatility for growth potential. Portfolio managers assess risk tolerance through detailed questionnaires and conversations.

2. Investment Timeline Considerations

How long you plan to invest matters. Longer horizons allow more equity exposure. Shorter timelines require more stable assets. A 30-year retirement plan differs completely from a 3-year education fund.

3. Return Objectives and Constraints

You need to balance desired returns with realistic expectations. Higher returns require accepting more risk. You also consider liquidity needs and tax implications. Understanding factors affecting investment decisions in portfolio management helps narrow down the final selection.

The efficient frontier from portfolio analysis shows your options. You select a portfolio from this frontier that aligns with your profile. Someone seeking moderate growth with lower risk picks differently than someone chasing maximum returns.

Ckredence Wealth helps clients through this selection process. We match portfolios to individual circumstances. Our four investment approaches—All Weather, Diversified, Business Cycle, and ICE Growth—provide different risk-return profiles to meet varied investor needs.

Portfolio selection is personal and specific. No single portfolio works for everyone. The right choice depends entirely on your financial situation and goals.

Phase 4: Portfolio Revision

What triggers the need to revise a portfolio?

Portfolio revision means making changes to your existing holdings. Markets don't stay still. Your portfolio needs updates to stay aligned with goals. This phase responds to both external and internal changes.

External Triggers for Revision:

Market conditions shift and change asset valuations

Interest rates move and affect bond prices

New investment opportunities emerge in different sectors

Economic cycles transition from growth to contraction

Internal Triggers for Revision:

Your financial goals change over time

Risk tolerance shifts with age or circumstances

Cash needs arise for major life events

Tax considerations require strategic adjustments

How Portfolio Revision Works:

Portfolio revision isn't random trading. It follows a disciplined approach. You compare current portfolio allocations against target allocations. Any significant deviation triggers review and potential action.

The process includes selling underperforming assets and buying better opportunities. You rebalance to maintain desired risk levels. Sometimes you hold positions despite short-term weakness when fundamentals remain strong.

Professional portfolio managers monitor holdings continuously. At Ckredence Wealth, we track client portfolios across market cycles. We make revisions based on research and analysis, not emotional reactions to market noise.

Costs matter during revision. Frequent trading creates tax implications and fees. Smart revision balances the need for changes against transaction costs. The goal is improving portfolio performance while managing expenses.

Phase 5: Portfolio Evaluation

Portfolio evaluation measures whether your investments are meeting expectations. This final phase reviews actual results against original goals. It tells you if the portfolio management process is working.

Here's what gets evaluated:

Performance Measurement

You compare actual returns to benchmarks. Did your equity portfolio beat the Nifty 50? Did your bonds outperform government securities? These comparisons show if active management added value.

Returns alone don't tell the full story. You also measure risk-adjusted performance. The Sharpe ratio shows returns per unit of risk taken. Higher ratios indicate better risk-adjusted performance.

Attribution Analysis

This digs deeper into performance sources. Did returns come from security selection or asset allocation? Attribution analysis separates skill from market movements. It shows which decisions helped and which hurt.

Portfolio evaluation also reviews costs and fees. High returns matter less if expenses eat into them. Net returns after all costs determine real investor benefits.

Using Evaluation Results

Evaluation findings feed back into the entire process. Poor security analysis leads to better research methods. Weak portfolio construction triggers different allocation approaches. The cycle improves with each iteration.

At Ckredence Wealth, we provide regular performance reports to clients. Our team analyzes results and explains drivers behind returns. This transparency helps investors understand their portfolio's journey and builds confidence in the management process.

Good evaluation requires honesty and data. You document what worked and what didn't. This learning improves future phases of portfolio management for better long-term results.

Why Should You Choose Ckredence Wealth for Portfolio Management?

Investment success requires more than understanding the five phases. You need experienced partners who apply these phases daily. Ckredence Wealth brings 37 years of portfolio management expertise to help you build wealth.

What sets us apart:

SEBI-Registered Portfolio Management Services: We operate under strict regulatory oversight with registration number INP000007164. Our Portfolio Management Services follow industry best practices across all five phases of portfolio management.

Proven Track Record: Managing ₹700+ Crores across 450+ active clients demonstrates trust and consistent results. Our clients rely on us for personalized wealth management that adapts to their changing needs.

Multiple Investment Approaches: Choose from four distinct strategies:

All Weather Investment Approach for stability across market conditions

Diversified Investment Approach for balanced growth

Business Cycle Investment Approach for economic cycle opportunities

ICE Growth Investment Approach for higher growth potential

Professional Portfolio Construction: Our team applies rigorous security analysis before any investment enters client portfolios. We use the complete five-phase framework for every account we manage.

Transparent Reporting: Receive regular updates on portfolio performance with clear explanations of decisions made during revision phases. You always know where you stand.

Ckredence Wealth serves HNIs and UHNIs across Gujarat and Maharashtra. Our regional presence allows personal interactions while maintaining institutional-quality portfolio management standards.

Ready to work with a trusted wealth management partner?Schedule a Consultation with our team today.

Conclusion

The 5 phases of portfolio management provide a proven framework for investment success. Security analysis finds quality assets. Portfolio analysis reveals optimal combinations. Selection matches portfolios to individual goals. Revision keeps portfolios current. Evaluation measures actual results and guides improvements.

Key points to remember:

Each phase requires specific expertise and connects to the others

Professional managers apply this framework continuously, not just once

The process adapts portfolios to changing markets while staying goal-focused

Working with experienced firms ensures all phases receive proper attention

Successful investing follows a disciplined process. Understanding these phases helps you evaluate portfolio managers and make better investment decisions for long-term wealth building.

FAQs

What are the main phases of portfolio management?

The five phases include security analysis, portfolio analysis, portfolio selection, portfolio revision, and portfolio evaluation. Each phase plays a specific role. Together they form a complete investment process.

How does security analysis differ from portfolio analysis?

Security analysis examines individual assets like stocks or bonds. Portfolio analysis combines multiple securities and calculates their collective risk and return. Security analysis happens first, portfolio analysis follows.

Why is portfolio revision necessary after initial selection?

Markets change constantly and affect asset values. Your goals may also shift over time. Portfolio revision keeps your investments aligned with current conditions and objectives through disciplined adjustments.

How often should portfolio evaluation be conducted?

Most professional managers evaluate portfolios quarterly at minimum. Some review monthly for active strategies. Annual reviews work for long-term passive approaches. Evaluation frequency depends on investment style and goals.

SEBI’s PMS disclosures show that Indian portfolio managers currently handle over ₹3.8 lakh crore in listed equity investments alone, underlining the widespread use of disciplined, multi-phase portfolio management frameworks across the industry. Each phase builds on the previous one. The process starts with researching individual assets and ends with measuring actual performance against goals.

How do you identify which stocks or bonds deserve a place in your portfolio?

What happens when market conditions change after you've already invested?

Can you measure if your portfolio is actually meeting your financial goals?

Professional portfolio management isn't about picking random stocks. It's a step-by-step method that helps investors make better choices. Understanding these five phases helps you see how wealth managers build and maintain investment portfolios that adapt to changing markets while staying focused on your long-term financial objectives.

Key Takeaways

Portfolio management follows five connected phases that build on each other sequentially

Security analysis forms the base where individual assets are researched before any portfolio is built

Portfolio revision is ongoing and adapts your holdings when markets shift or goals change

Performance evaluation measures actual returns against benchmarks to guide future decisions

Professional managers use all five phases together to build portfolios that match investor risk profiles

Each phase requires specific skills from fundamental analysis to mathematical modeling

The process repeats continuously rather than stopping after initial portfolio construction

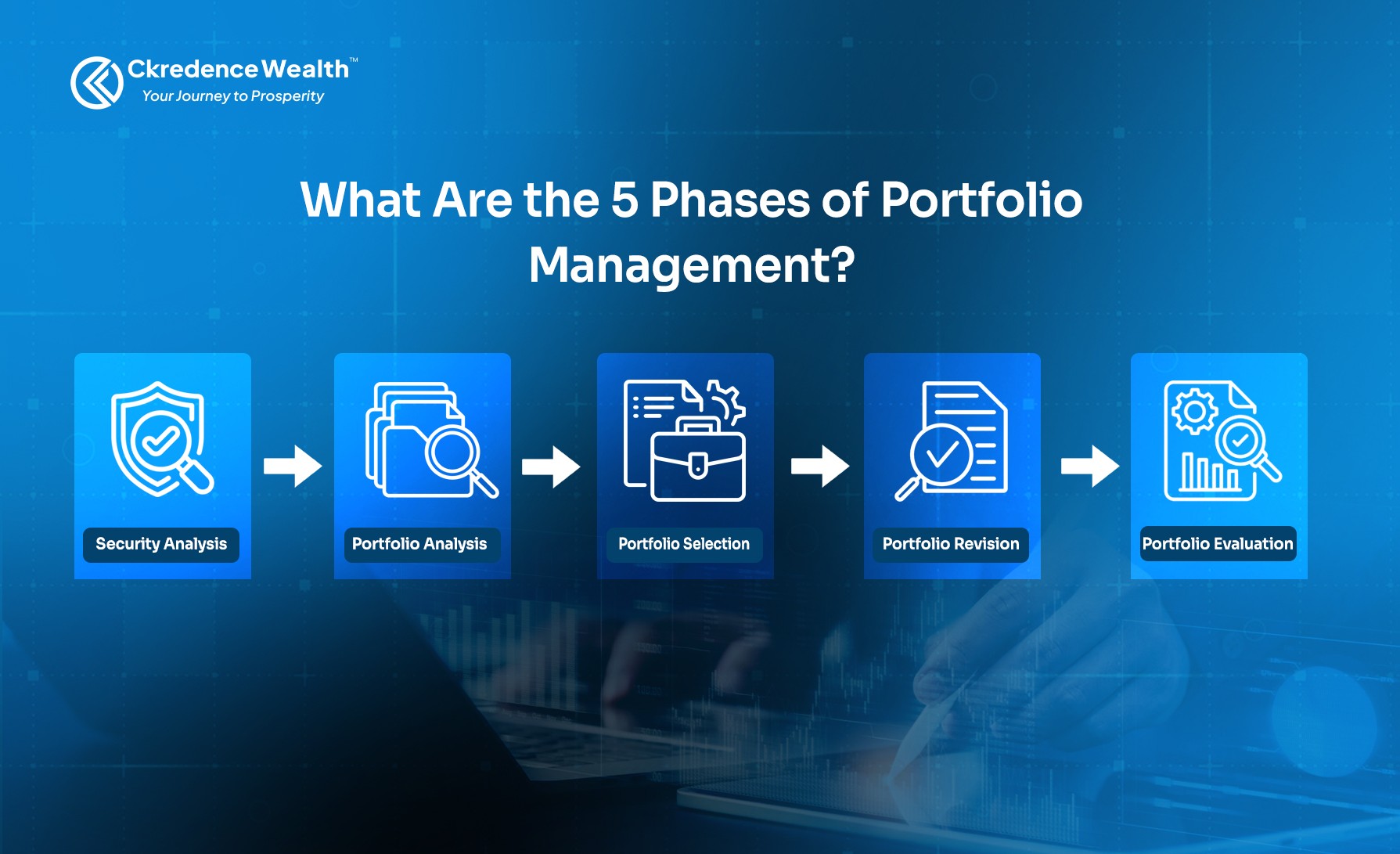

What Are the 5 Phases of Portfolio Management?

The 5 phases of portfolio management create a full cycle for investing. This process helps investors build and maintain portfolios that match their financial goals. Each phase serves a specific purpose in portfolio construction.

The phases work together as a system. You start by analyzing individual securities. Then you combine them into a portfolio. After that, you select the best mix. Next, you adjust when needed. Finally, you measure results.

Here's how the phases connect:

Security Analysis - Research individual assets to find investment opportunities

Portfolio Analysis - Combine securities and calculate risk-return profiles

Portfolio Selection - Choose the optimal portfolio from available options

Portfolio Revision - Adjust holdings based on market changes or goal shifts

Portfolio Evaluation - Measure actual performance against objectives

This cycle repeats throughout your investment journey. Markets change, goals evolve, and new opportunities appear. The five phases of portfolio management help investors respond to these changes while staying disciplined.

Professional portfolio management services use this framework daily. Each phase requires different skills and tools. Together, they form a complete method for managing wealth across market cycles.

Phase 1: Security Analysis

Security analysis examines individual investment options before they enter any portfolio. This phase looks at stocks, bonds, and other assets to determine their true value. Portfolio managers use both fundamental and technical analysis to make these assessments.

The research process includes:

Fundamental Analysis This method studies a company's financial health. Managers review balance sheets, profit margins, and cash flows. They also look at management quality and competitive advantages. The goal is to find assets trading below their actual worth.

Technical Analysis This approach examines price patterns and trading volumes. Analysts identify trends that suggest future price movements. Chart patterns and indicators help time entry and exit points for investments.

Industry and Economic Factors No company exists in isolation. Security analysis also considers sector trends and economic conditions. Interest rates, inflation, and regulatory changes all affect asset values. These factors help predict how securities might perform.

Security analysis requires deep research and expertise. At Ckredence Wealth, our team spends significant time on this phase. We analyze financial statements, meet with management teams, and track industry developments to identify quality investment opportunities for our clients.

This phase determines which assets qualify for portfolio inclusion. Strong security analysis prevents costly mistakes. It forms the foundation for all later phases in portfolio management.

Phase 2: Portfolio Analysis

Portfolio analysis takes the securities you've researched and combines them into different portfolio options. This phase uses mathematics to calculate expected returns and risks for each possible combination. The goal is to understand how different assets work together.

The key steps involved are:

Step 1: Calculate Expected Returns You estimate what each portfolio combination might earn. This uses historical data and future projections. Different weightings of assets produce different expected returns.

Step 2: Measure Portfolio Risk Risk calculation looks at return volatility. You also measure how securities move together through correlation. Lower correlation between assets reduces overall portfolio risk.

Step 3: Find the Efficient Frontier This is a graph showing portfolios that offer the best returns for each risk level. Any portfolio below this line is inefficient. It means you could get better returns for the same risk.

Portfolio analysis relies on Modern Portfolio Theory principles. Diversification reduces risk without sacrificing returns. The math shows that combining assets properly produces better outcomes than investing in single securities.

This phase reveals which portfolio combinations make sense. Some offer high returns but also high risk. Others provide stability with modest gains. The analysis shows all available options before you make final selections.

Professional managers use software to run thousands of scenarios. They test how portfolios might perform under different market conditions. This helps identify robust combinations that work across various economic environments.

Phase 3: Portfolio Selection

Portfolio selection means picking the specific portfolio that matches your investment goals. You've analyzed individual securities and calculated risk-return profiles. Now you choose which combination fits your situation best.

This decision depends on three main factors:

1. Risk Tolerance Assessment

Your comfort with market volatility shapes portfolio choice. Conservative investors prefer stable assets like bonds. Aggressive investors accept higher volatility for growth potential. Portfolio managers assess risk tolerance through detailed questionnaires and conversations.

2. Investment Timeline Considerations

How long you plan to invest matters. Longer horizons allow more equity exposure. Shorter timelines require more stable assets. A 30-year retirement plan differs completely from a 3-year education fund.

3. Return Objectives and Constraints

You need to balance desired returns with realistic expectations. Higher returns require accepting more risk. You also consider liquidity needs and tax implications. Understanding factors affecting investment decisions in portfolio management helps narrow down the final selection.

The efficient frontier from portfolio analysis shows your options. You select a portfolio from this frontier that aligns with your profile. Someone seeking moderate growth with lower risk picks differently than someone chasing maximum returns.

Ckredence Wealth helps clients through this selection process. We match portfolios to individual circumstances. Our four investment approaches—All Weather, Diversified, Business Cycle, and ICE Growth—provide different risk-return profiles to meet varied investor needs.

Portfolio selection is personal and specific. No single portfolio works for everyone. The right choice depends entirely on your financial situation and goals.

Phase 4: Portfolio Revision

What triggers the need to revise a portfolio?

Portfolio revision means making changes to your existing holdings. Markets don't stay still. Your portfolio needs updates to stay aligned with goals. This phase responds to both external and internal changes.

External Triggers for Revision:

Market conditions shift and change asset valuations

Interest rates move and affect bond prices

New investment opportunities emerge in different sectors

Economic cycles transition from growth to contraction

Internal Triggers for Revision:

Your financial goals change over time

Risk tolerance shifts with age or circumstances

Cash needs arise for major life events

Tax considerations require strategic adjustments

How Portfolio Revision Works:

Portfolio revision isn't random trading. It follows a disciplined approach. You compare current portfolio allocations against target allocations. Any significant deviation triggers review and potential action.

The process includes selling underperforming assets and buying better opportunities. You rebalance to maintain desired risk levels. Sometimes you hold positions despite short-term weakness when fundamentals remain strong.

Professional portfolio managers monitor holdings continuously. At Ckredence Wealth, we track client portfolios across market cycles. We make revisions based on research and analysis, not emotional reactions to market noise.

Costs matter during revision. Frequent trading creates tax implications and fees. Smart revision balances the need for changes against transaction costs. The goal is improving portfolio performance while managing expenses.

Phase 5: Portfolio Evaluation

Portfolio evaluation measures whether your investments are meeting expectations. This final phase reviews actual results against original goals. It tells you if the portfolio management process is working.

Here's what gets evaluated:

Performance Measurement

You compare actual returns to benchmarks. Did your equity portfolio beat the Nifty 50? Did your bonds outperform government securities? These comparisons show if active management added value.

Returns alone don't tell the full story. You also measure risk-adjusted performance. The Sharpe ratio shows returns per unit of risk taken. Higher ratios indicate better risk-adjusted performance.

Attribution Analysis

This digs deeper into performance sources. Did returns come from security selection or asset allocation? Attribution analysis separates skill from market movements. It shows which decisions helped and which hurt.

Portfolio evaluation also reviews costs and fees. High returns matter less if expenses eat into them. Net returns after all costs determine real investor benefits.

Using Evaluation Results

Evaluation findings feed back into the entire process. Poor security analysis leads to better research methods. Weak portfolio construction triggers different allocation approaches. The cycle improves with each iteration.

At Ckredence Wealth, we provide regular performance reports to clients. Our team analyzes results and explains drivers behind returns. This transparency helps investors understand their portfolio's journey and builds confidence in the management process.

Good evaluation requires honesty and data. You document what worked and what didn't. This learning improves future phases of portfolio management for better long-term results.

Why Should You Choose Ckredence Wealth for Portfolio Management?

Investment success requires more than understanding the five phases. You need experienced partners who apply these phases daily. Ckredence Wealth brings 37 years of portfolio management expertise to help you build wealth.

What sets us apart:

SEBI-Registered Portfolio Management Services: We operate under strict regulatory oversight with registration number INP000007164. Our Portfolio Management Services follow industry best practices across all five phases of portfolio management.

Proven Track Record: Managing ₹700+ Crores across 450+ active clients demonstrates trust and consistent results. Our clients rely on us for personalized wealth management that adapts to their changing needs.

Multiple Investment Approaches: Choose from four distinct strategies:

All Weather Investment Approach for stability across market conditions

Diversified Investment Approach for balanced growth

Business Cycle Investment Approach for economic cycle opportunities

ICE Growth Investment Approach for higher growth potential

Professional Portfolio Construction: Our team applies rigorous security analysis before any investment enters client portfolios. We use the complete five-phase framework for every account we manage.

Transparent Reporting: Receive regular updates on portfolio performance with clear explanations of decisions made during revision phases. You always know where you stand.

Ckredence Wealth serves HNIs and UHNIs across Gujarat and Maharashtra. Our regional presence allows personal interactions while maintaining institutional-quality portfolio management standards.

Ready to work with a trusted wealth management partner?Schedule a Consultation with our team today.

Conclusion

The 5 phases of portfolio management provide a proven framework for investment success. Security analysis finds quality assets. Portfolio analysis reveals optimal combinations. Selection matches portfolios to individual goals. Revision keeps portfolios current. Evaluation measures actual results and guides improvements.

Key points to remember:

Each phase requires specific expertise and connects to the others

Professional managers apply this framework continuously, not just once

The process adapts portfolios to changing markets while staying goal-focused

Working with experienced firms ensures all phases receive proper attention

Successful investing follows a disciplined process. Understanding these phases helps you evaluate portfolio managers and make better investment decisions for long-term wealth building.

FAQs

What are the main phases of portfolio management?

The five phases include security analysis, portfolio analysis, portfolio selection, portfolio revision, and portfolio evaluation. Each phase plays a specific role. Together they form a complete investment process.

How does security analysis differ from portfolio analysis?

Security analysis examines individual assets like stocks or bonds. Portfolio analysis combines multiple securities and calculates their collective risk and return. Security analysis happens first, portfolio analysis follows.

Why is portfolio revision necessary after initial selection?

Markets change constantly and affect asset values. Your goals may also shift over time. Portfolio revision keeps your investments aligned with current conditions and objectives through disciplined adjustments.

How often should portfolio evaluation be conducted?

Most professional managers evaluate portfolios quarterly at minimum. Some review monthly for active strategies. Annual reviews work for long-term passive approaches. Evaluation frequency depends on investment style and goals.